Kavout Predictive Equity Rating K Score Now Available via Open:FactSet

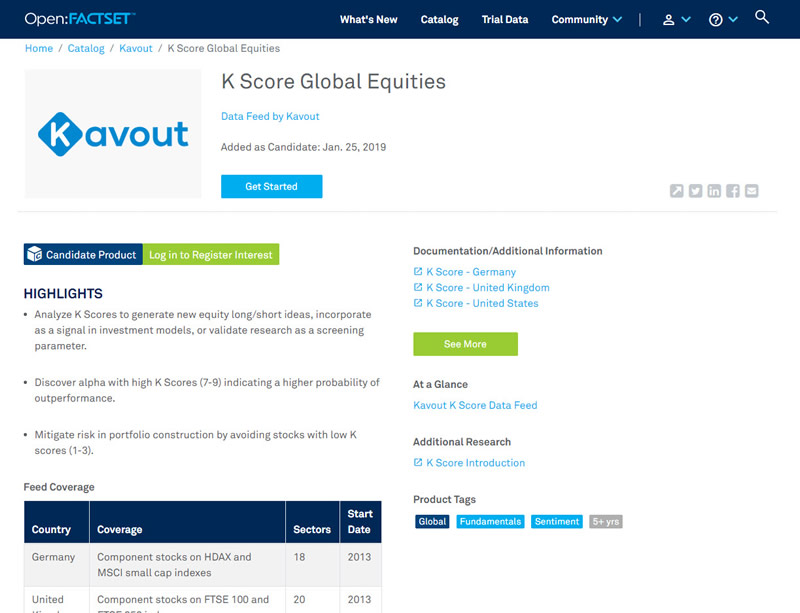

SEATTLE, Aug. 20, 2019 /PRNewswire-PRWeb/ — Kavout is excited to announce that its K Score, a predictive equity rating data feed is now available via the Open:FactSet Marketplace (OFM).

“At Kavout, we believe the role of using advanced machine learning techniques to uncover signals and intrinsic relationships that in turn deliver alpha and minimize risk,” says Isabell Sheang, Chief Commercial Officer. “As our global K Score coverage grows, we are excited to work with FactSet to provide institutions and professional investors with our unique signals that complement their own models and research.”

The K Score is a Quantamental rating powered by ensemble machine learning techniques that take in a diverse array of datasets including fundamentals, price and volume, and alternative data, to deliver an easy-to-understand 1 to 9 equity rating score delivered daily as data feed.

Kavout is a registered Evaluation Provider on Open:FactSet Marketplace (OFM). Equity buyside firms can find K Score for China A-share, for United States and other global equity markets. FactSet’s Evaluation Program allows clients to trial potential new datasets and solutions before they become available as fully integrated products on the OFM. Providers are reviewed and screened by FactSet before being accepted into the program.

About Kavout

Kavout is a global investment technology company that specializes in the application of machine learning to generate alpha, manage wealth, and empowering institutions and investors do more with less. Kavout brings together a world-class team of researchers, financial engineers, and machine learning experts to develop investment services of the next generation. http://www.kavout.com

SOURCE Kavout

Related Links

Contact us

Contact us today to learn more about Kavout's products or services.