Momentum Magic Formula Strategy: Outperforming SPY with a 68% Higher Return from September to Early October

What Is Joel Greenblatt’s Magic Formula?

The Magic Formula, developed by renowned investor Joel Greenblatt, is a disciplined, value-oriented investment strategy that aims to identify undervalued companies that are also high-quality. It focuses on two key financial metrics:

- Earnings Yield: A measure of how much earnings a company generates relative to its stock price, indicating whether the stock is undervalued.

- Return on Capital (ROC): A measure of how efficiently a company uses its capital to generate profits, highlighting the quality of the company.

The Magic Formula helps investors select stocks with high earnings yield and strong return on capital, providing a list of companies that are financially solid and trading at a discount to their intrinsic value. This strategy is based on value investing principles, aiming to buy great companies at a good price.

Enhancing the Magic Formula with Momentum

While Greenblatt’s Magic Formula excels in identifying undervalued stocks with solid fundamentals, it doesn’t take into account price trends or momentum—key indicators of whether a stock is gaining favor in the market. This is where the Momentum Magic Formula enhances the original approach. In our Momentum Magic Formula strategy, we combine the value fundamentals of Greenblatt’s Magic Formula with momentum signals, ensuring that the selected stocks not only have strong financials but are also showing upward price momentum. This addition allows us to capture stocks that are both undervalued and benefiting from positive market trends.

Performance Highlights (September to Early October)

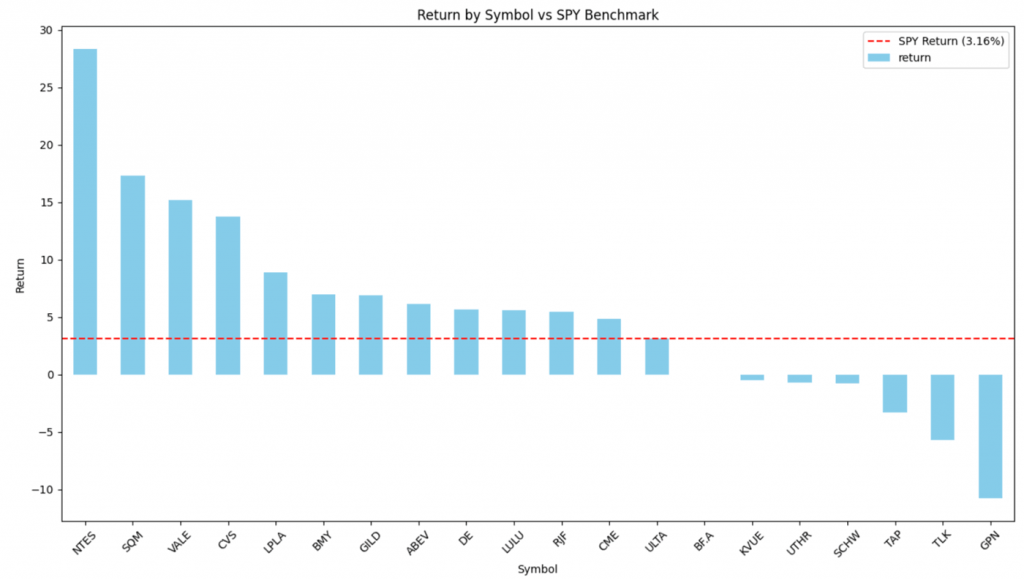

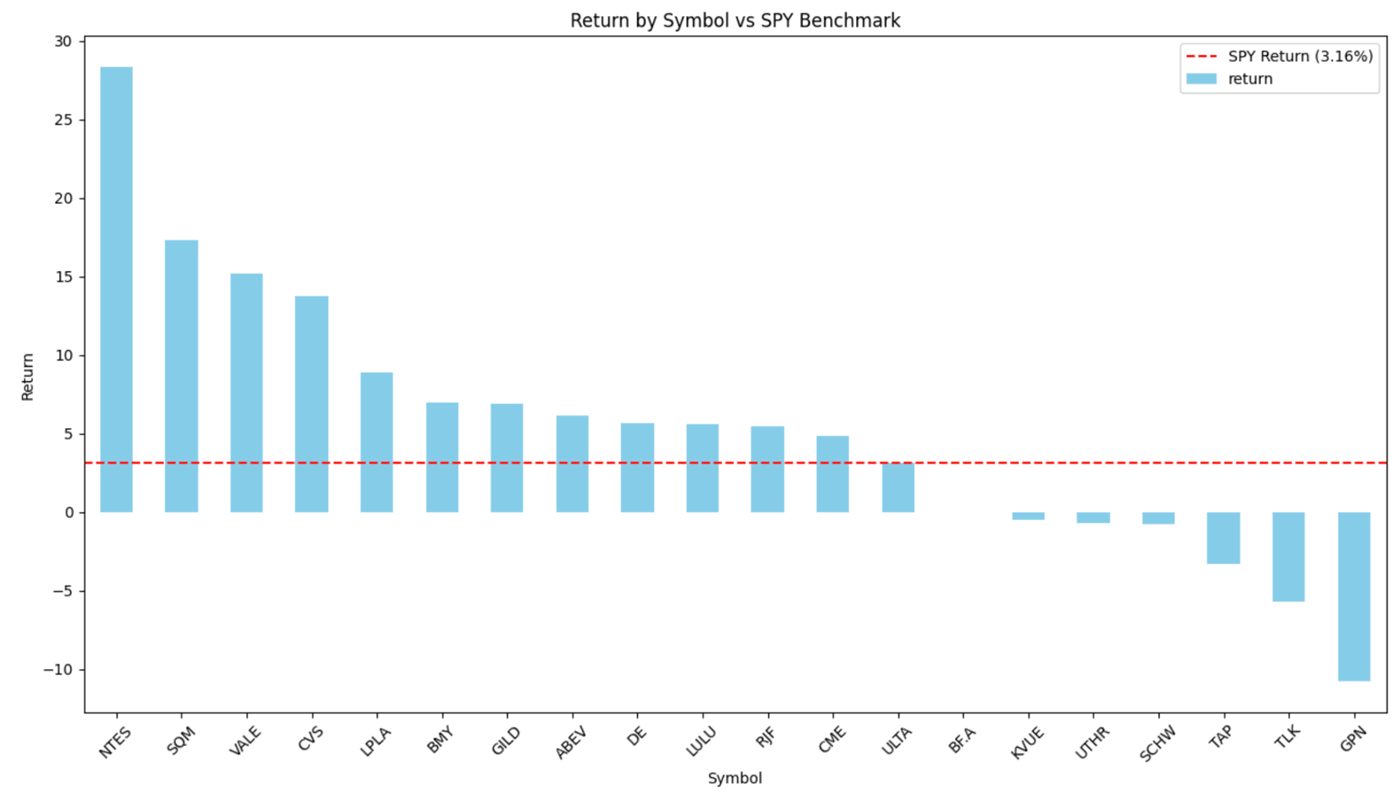

- NTES was the top performer during the period, delivering a return of 28.34%, showcasing the success of targeting undervalued companies with strong momentum signals.

- SQM and VALE followed closely with returns of 17.29% and 15.20%, respectively, further proving the power of combining value fundamentals with momentum to capture growth opportunities.

- Overall, the top 20 stocks selected by the strategy achieved an average return of 5.32%, significantly outpacing the SPY’s return of 3.16%, a 68% higher return. Stocks like CVS and LPLA also delivered strong returns of 13.72% and 8.86%, respectively.

What Makes the Difference?

The Momentum Magic Formula stands out by blending two distinct yet complementary investment approaches:

- Value Fundamentals: The strategy prioritizes stocks with high Earnings Yield and strong Return on Capital, filtering for companies that are undervalued yet financially stable.

- Momentum Factor: By adding a momentum component, the strategy capitalizes on stocks that are already showing upward price trends, ensuring that investors not only buy into undervalued companies but also take advantage of positive market sentiment.

How to Use the Momentum Magic Formula

The Momentum Magic Formula strategy can help you find undervalued stocks that are also benefiting from upward price momentum. Here’s how you can use it to make more informed investment decisions:

- Use the Stock Picks as Potential Ideas: The stocks in this strategy’s pool are selected based on their high Earnings Yield, strong Return on Capital, and positive price momentum. These picks serve as potential stock ideas to start your research. Use InvestGPT Pro to access the list of these curated stocks.

- Conduct Your Own Research: Once you’ve identified potential stocks, take the time to perform your own detailed research. InvestGPT Pro enables you to check financial data, run technical analyses, compare stocks, and even review earnings reports, industry trends, and analysts’ opinions. This extra step will help ensure that the stocks fit your investment goals.

- Use Momentum for Timing: After confirming that a stock has strong fundamentals and is undervalued, use momentum signals to time your entry and exit points. InvestGPT Pro provides insights into momentum trends, helping you identify the right moments to buy or sell for maximum gain.

By following these steps, you can use the Momentum Magic Formula as a powerful tool to generate high-quality stock ideas, refine them with thorough research, and leverage price trends for better timing.

Managing Underperformers

While most stocks in the portfolio outperformed, a few, like GPN with a return of -10.77% and TLK with -5.70%, delivered negative results. This highlights the inherent volatility in the market. However, the strategy’s combination of value and momentum helps mitigate the impact of these underperformers by focusing on stocks with solid financials and growth potential.

Unlock More with InvestGPT Pro

The Momentum Magic Formula is just one of the powerful stock-picking strategies available in the InvestGPT Pro plan. Alongside this, the Pro plan offers access to 12+ AI Stock Picker strategies, each tailored to different investing styles, helping you generate high-quality stock trade ideas. With InvestGPT, you can perform complex analyses, check financial information, compare stocks, and get detailed insights into market trends—all in one place.

Conclusion

The Momentum Magic Formula delivered strong results, with an average return of 5.32%, which is 68% higher than the S&P 500 during the same period. By combining the value investing principles of Joel Greenblatt’s Magic Formula with momentum signals, this strategy is designed to help investors find undervalued stocks that are poised for growth and sustained performance.

Call to Action:

Subscribe to InvestGPT Pro today and discover how the Momentum Magic Formula can help you unite value investing with momentum to make smarter stock picks. Explore all 12+ AI Stock Picker strategies and take control of your portfolio with data-driven insights and powerful AI tools.

Send us a Message

Contact us

Contact us today to learn more about Kavout's products or services.