Technology – Kai Enhanced Sector Portfolio

Today, we apply our Machine Learning methodologies to one of the most active sectors on the stock market: technology.

The Kai-ESP is a portfolio that gives full sector exposure and concentrates on the stocks with the highest potential. We built our portfolio based on established trading strategies but augmented with Machine Learning algorithms.

Stocks are selected based on K Scores– stock ratings that are rooted in fundamental rule-based factor investing, and enhanced using machine learning. Stocks ratings take into consideration new information and are updated daily. To seek maximum risk-adjusted returns the portfolio strategy is rebalanced and asset allocation is optimized for both holdings and weights.

This quantamental approach works across sectors and allows us to capture the best growth cycle of any sector.

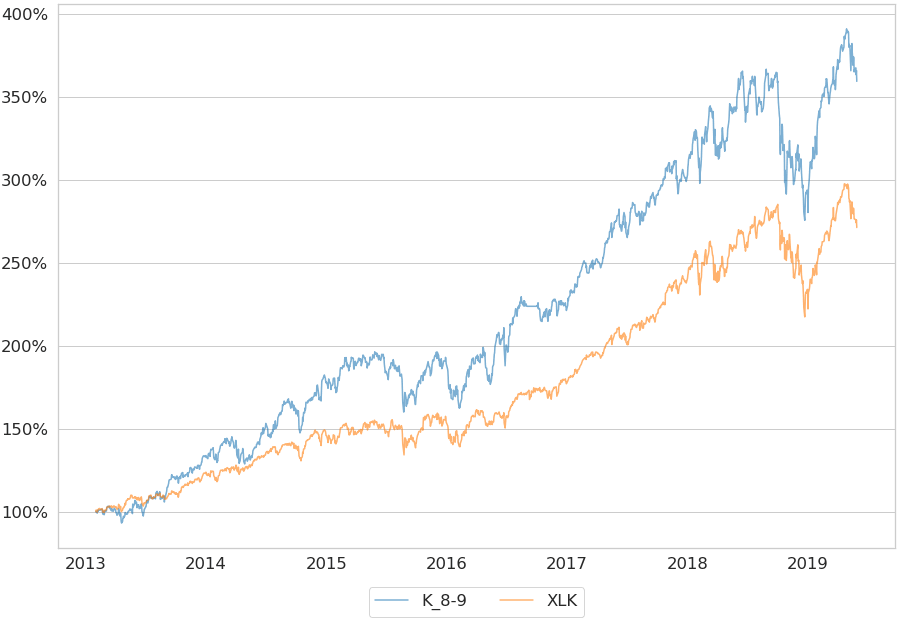

For this scenario we built our portfolio using K Scores of 8-9, and rebalanced every month. We used the XLK ETF as the benchmark for our analysis.

The average holding in our portfolio over this period was 22 companies. Below are some of the top holdings and their proportions:

| HP Inc. | 4.20 |

| ServiceNow, Inc. | 3.27 |

| Salesforce.com, inc. | 2.90 |

| Splunk Inc. | 2.79 |

| Electronic Arts Inc. | 2.70 |

| STMicroelectronics NV ADR RegS | 2.49 |

By looking at the graph below, we see that the Kai-ESP over time has outperformed the XLK.

If you want to see the full-fact sheet with our latest data, please click the button below.

We had so much fun looking into the Technology sector, that we are running scenarios for more of the sectors that Kavout covers. Were you able to see our Kai-ESP for Health Care? Watch our blog as we release them. To learn more about Kavout’s other portfolio offerings, please visit our model portfolio page. Contact us to learn more about how you can incorporate our AI and Machine Learning technology into your business.

Send us a Message

Contact us

Contact us today to learn more about Kavout's products or services.