Two-tier sector rotation portfolio: A data-driven quantitative approach to a multi-layer tactical asset allocation

At Kavout, we believe that the application of artificial intelligence (AI) and machine learning (ML) is the next transformative force to change the investment and wealth management landscape. Kavout has developed model portfolios based on vetted and established trading strategies, augmented with AI algorithms. In this article, we present a recent example of a two-tier sector rotation portfolio.

Smart Selector + Market-Adaptive Rotation

To create a two-tier sector portfolio (get the factsheet), we analyze hundreds of stocks included in major ETFs and constantly update our results. This ensures a balanced exposure between top-quality assets that ride on short-term momentum and assets that seek long-term growth.

With the two-tier portfolio construction approach, our Kai engine dynamically selects top stocks within each sector based on price momentums, volatilities, correlations, and other factors, to form a base-tier sector portfolio.

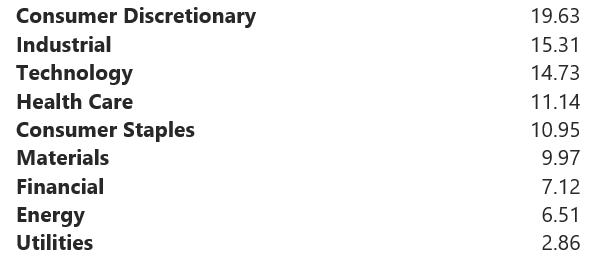

The top-tier portfolio is formed by dynamically selecting the best performing base-tier portfolios associated with different sectors and rotating adaptively to market conditions. The chart below shows an example of how the portfolio is allocated across different sectors.

Top Sector Exposure (%)

The Kavout AI engine covers all stocks across many sectors but concentrates on the stocks with the highest potential. The selection is conducted using data-driven quantamental analytics and machine learning models, and stocks go through multiple rounds of comparison and selection in order to be included in the portfolio. The portfolio holdings are dynamically optimized to seek maximum risk-adjusted returns.

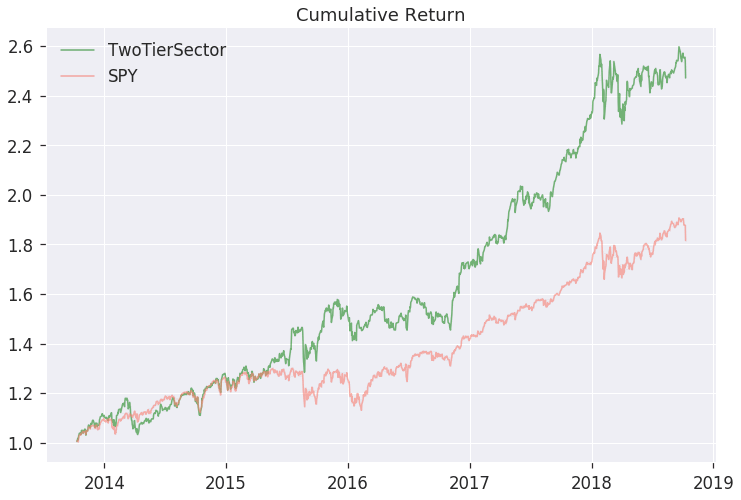

As the graph below illustrates, the Multi-layer Tactical Asset Allocation portfolio (Two-tier Sector) has significantly outperformed the benchmark SPY since 2014.

To learn more about Kavout’s other portfolio offerings, please visit our model portfolio page. In addition to smart portfolio construction, we provide rating services for other asset classes, AI stock picks or recommendations, and algorithmic trading. Contact us to learn more about how you can incorporate our AI and Machine Learning technology into your business.

Send us a Message

Contact us

Contact us today to learn more about Kavout's products or services.