Use Case: K Score for the German Market

In April we announced that the K Score was available for the German market. We have been fortunate to have our new clients give us positive feedback on our machine learning-driven rating and ranking system.

Due to this strong reception, we built a portfolio showing how the K Score performs on German stocks. In this scenario, which we call the Top Picks Portfolio, we assumed an investment capital of $1,000,000, with an average holding between 25 to 35 stocks. In this portfolio, we chose K Scores of 8 to 9 and rebalanced monthly. We also used the DAX 30 as our benchmark, which consists of the 30 German companies with the largest market cap traded on the Frankfurt Stock Exchange. The strategy applied equal weight to all chosen stocks, and the timeline is from 2013-01-09 to 2019-05-31. We assumed 8 bps for the transaction cost.

Below are the top holdings and their proportions:

TOP 10 HOLDINGS

| Aareal Bank AG | 3.11 |

| Munich Reinsurance Company | 2.96 |

| Talanx AG | 2.92 |

| Allianz SE | 2.83 |

| Commerzbank AG | 2.73 |

| Deutsche Bank AG | 2.67 |

| Hannover Ruck SE | 2.45 |

| Deutsche Wohnen SE | 2.38 |

| TAG Immobilien AG | 1.96 |

| Deutsche Boerse AG | 1.87 |

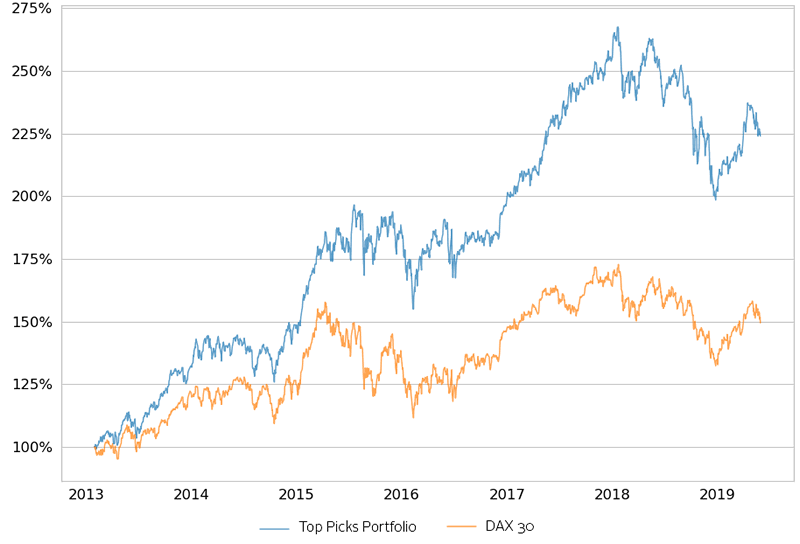

Over the time period, we see the cumulative returns of the Top Picks Portfolio in comparison to the DAX 30 benchmark.

CUMULATIVE RETURNS

PERFORMANCE

| Top Picks Portfolio | DAX 30 | |

| Annual return | 13.52% | 6.49% |

| Cumulative returns | 123.93% | 49.41% |

| Annual volatility | 16.94% | 17.34% |

| Sharpe ratio | 0.83 | 0.45 |

| Sortino ratio | 1.18 | 0.63 |

| Alpha | 0.07 | 0 |

| Beta | 0.87 | 1 |

As the graph and Performance chart shows, the Top Picks Portfolio significantly outperformed the DAX 30 benchmark. The Annual return of 13.52% beat the benchmark of 6.49%, and the cumulative returns of 123.93% outperformed the DAX 30 cumulative returns of 49.41%.

When adjusting for volatility, the Sharpe Ratio and the Sortino Ratio do well in the Top Picks Portfolio. The Sharpe Ratio for the Top Picks Portfolio is 0.83 compared to the DAX 30 being 0.45, while the Sortino Ratio is 1.18 for the Top Picks Portfolio versus the DAX 30 being 0.63.

If you are interested in learning more about K Score not only for Germany, but also for the US, China A-Share, and United Kingdom, please contact us by pressing the button below.

* This is for information purpose only and past performance does not guarantee the future.

Send us a Message

Contact us

Contact us today to learn more about Kavout's products or services.