MarketLens

Bank of Japan Holds Rates Steady as Nikkei Leads Asia-Pacific Gains: Impact of BoJ, PBoC, and Fed Decisions

Bank of Japan’s Monetary Policy Decision

Background and Recent Developments

The BoJ’s decision to maintain its short-term interest rate target in the range of 0.15% to 0.25% was made unanimously during a two-day monetary policy review meeting in September 2024. This decision comes after a 15 basis point increase in July 2024, which was the first rate hike in 17 years. The July hike moved the policy rate from 0%-0.1% to 0.15%-0.25%, signaling a shift in the BoJ’s approach to monetary policy.

Economic Context and Rationale

The BoJ noted that Japan’s economy is recovering moderately, although some weaknesses persist. Inflation expectations are rising moderately, with the bank projecting inflation to be at levels generally consistent with its 2% price target during the second half of its three-year projection period through fiscal 2026. The BoJ also outlined plans to taper its monthly outright purchases of Japanese government bonds to about JPY 3 trillion per month starting in the first quarter of 2026.

Market Reactions

Following the BoJ’s announcement, the USD/JPY initially rose to around 143.00 before retreating to approximately 142.65. The Japanese yen (JPY) was noted to be the weakest against the Swiss Franc among major currencies. The BoJ’s decision to hold rates steady highlights its cautious approach to managing the economy and its vigilance regarding the impacts of financial and foreign exchange market movements on the economy and prices.

Performance of the Nikkei 225 Index

Recent Gains and Market Sentiment

In September 2024, Japan’s Nikkei 225 Index gained 0.5%, while the broader TOPIX Index declined by 1.0%. This mixed performance occurred amid currency headwinds and a hawkish outlook from the BoJ. Investors have been actively seeking undervalued opportunities in this environment, particularly in small-cap stocks.

Impact of Wall Street Rally

The positive sentiment on Wall Street, following the U.S. Federal Reserve’s first interest rate cut in over four years, significantly influenced markets across the Asia-Pacific region. On September 18, 2024, Wall Street experienced a significant rally, with the S&P 500 rising 1.7%, the Dow Jones Industrial Average jumping 522 points (1.3%), and the Nasdaq composite surging 2.5%. This rally bolstered investor confidence and led to a widespread uplift in stock prices globally.

Comparative Performance in Asia-Pacific Markets

Following the BoJ’s decision to keep rates steady, Japan’s Nikkei 225 index surged by 2.1%, reaching 37,935.58. This rise came after the U.S. Federal Reserve’s significant interest rate cut, which also contributed to positive sentiment in Asian stock markets. In addition to the Nikkei’s gains, the Hang Seng index in Hong Kong increased by 1.1% to 18,206.68, while South Korea’s Kospi rose by 0.8% to 2,600.29. However, the Shanghai Composite index in China experienced a slight decline of 0.2% to 2,729.69.

People’s Bank of China (PBoC) Monetary Policy

Recent Decisions and Economic Context

The People’s Bank of China (PBoC) also opted not to change its key lending rates in September 2024, maintaining the one-year loan prime rate at 3.35% and the five-year LPR at 3.85%. This decision reflects the PBoC’s cautious approach to managing economic activity amid global economic fluctuations.

Impact on Regional Markets

The stability in rates by both the BoJ and PBoC reflects cautious optimism in the Asia-Pacific region. The decisions by these central banks come amidst a backdrop of economic activity, with Japan’s Nikkei 225 index rising 1.87% and U.S. markets showing strong gains. The Dow Jones Industrial Average increased by 1.26% to close at 42,025.19, marking a significant milestone.

Broader Economic Implications

Inflation and Price Stability

Japan’s core consumer price index rose by 2.8% year-on-year in August 2024, exceeding the BoJ’s 2% target and leaving room for potential future rate hikes. Excluding fresh food and energy, inflation was reported at 2%, slightly higher than the previous 1.9%. This indicates that inflationary pressures are building, which could influence future monetary policy decisions.

Currency Headwinds and Trade Dynamics

Currency headwinds have been a significant factor in the performance of Japanese markets. The JPY’s weakness against major currencies, particularly the Swiss Franc, has implications for trade dynamics and export competitiveness. The BoJ’s vigilance regarding the impacts of financial and foreign exchange market movements underscores the importance of managing currency volatility in the current economic environment.

Investor Sentiment and Market Opportunities

The mixed performance of the Nikkei 225 and TOPIX indices highlights the nuanced investor sentiment in Japan. While the Nikkei 225 gained 0.5%, the broader TOPIX Index declined by 1.0%. Investors are actively seeking undervalued opportunities, particularly in small-cap stocks, amid currency headwinds and a hawkish outlook from the BoJ.

Conclusion

The Bank of Japan’s decision to keep interest rates steady in September 2024, following a significant rate hike in July, reflects a cautious approach to managing the economy amid rising inflation expectations and moderate economic recovery. The positive sentiment on Wall Street, following the U.S. Federal Reserve’s interest rate cut, has significantly influenced markets across the Asia-Pacific region, with Japan’s Nikkei 225 index leading gains.

The People’s Bank of China’s decision to maintain its key lending rates further underscores the cautious optimism in the region. The stability in rates by both central banks reflects a balanced approach to managing economic activity amid global economic fluctuations.

Overall, the BoJ’s decision to hold rates steady highlights its vigilance regarding the impacts of financial and foreign exchange market movements on the economy and prices. The mixed performance of Japanese stock indices and the active search for undervalued opportunities by investors underscore the complex dynamics at play in the current economic environment.

Related Articles

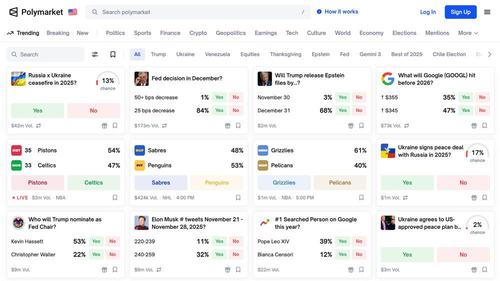

The Rise of Prediction Markets

Category

You may also like

No related articles available

Breaking News

View All →No topics available at the moment