Beta Access: Dive into Large Cap Stock Analysis with Comprehensive Financial Statements

Fundamental analysis of stocks is a critical exercise for investors and finance professionals alike. It involves a deep dive into a company’s financial statements—the balance sheet, income statement, and cash flow statement—to evaluate its financial health and future prospects. This report will provide an in-depth analysis of these three financial statements and how they interrelate to offer insights into a company’s performance.

Exciting news! We’re thrilled to announce our beta launch, offering you complimentary access to comprehensive stock analyses for large cap stocks. Soon, we’ll expand our coverage to include all US stocks. With our service, you can bypass the overwhelming task of dissecting hundreds of financial statement items. Instead, effortlessly receive crucial observations and analyses at no cost. Join us now and be at the forefront of streamlined financial insights!

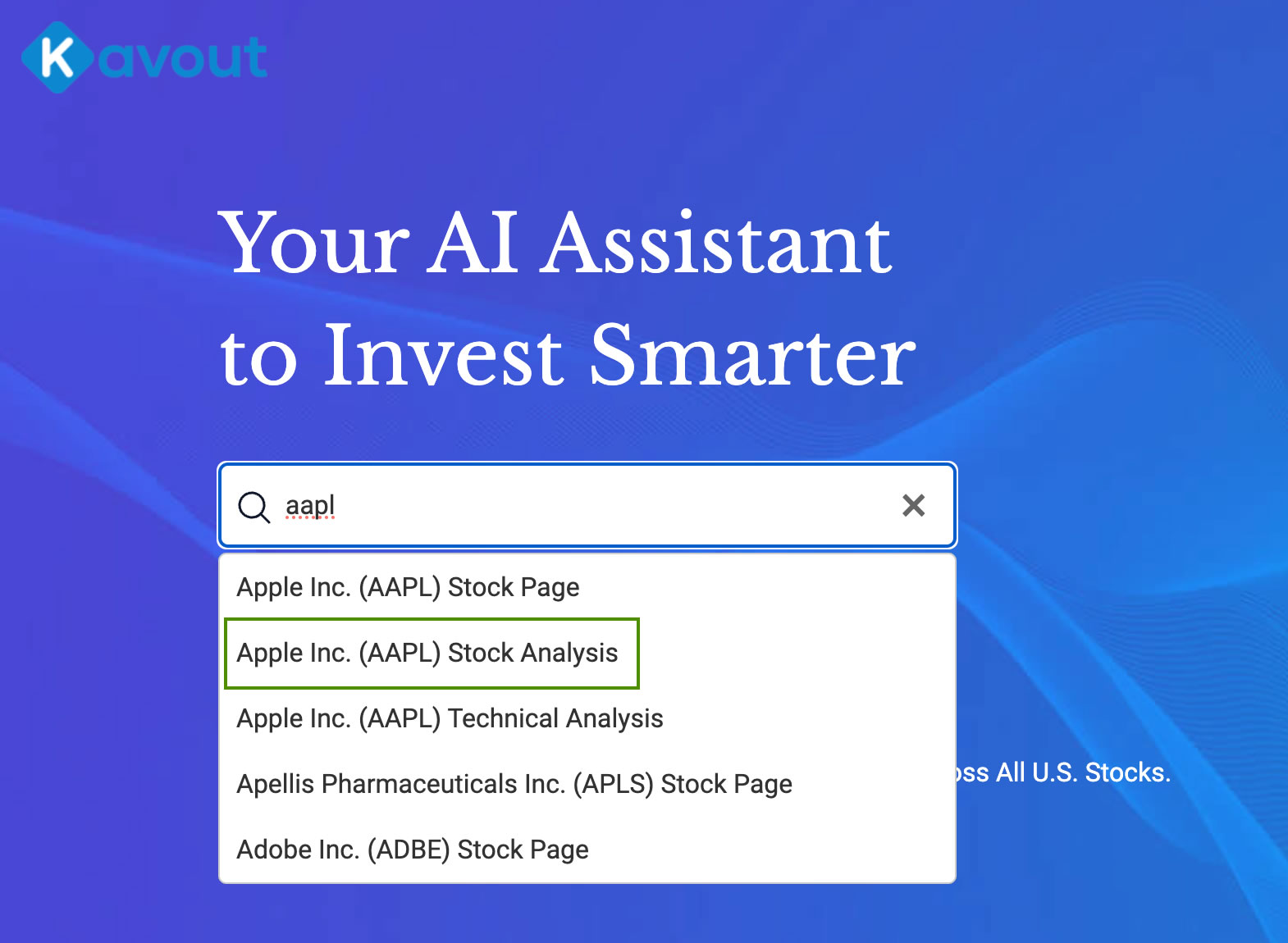

Simply visit kavout.com, and in the search box, enter the symbol of any large cap stock you’re interested in. Select ‘Stock Analysis’ and you’ll be seamlessly guided to a detailed investment analysis report. Discover insightful data on your chosen stocks with just a few clicks!

Example Investment Reports:

ASML Stock Analysis BABA Stock Analysis SNOW Stock Analysis

The Balance Sheet Analysis

The balance sheet, or the statement of financial position, presents a snapshot of a company’s financial condition at a specific point in time. It lists the company’s assets, liabilities, and shareholders’ equity. The balance sheet is crucial for assessing the company’s capital structure and liquidity. The assets should ideally be financed by a mix of debt and equity that optimizes the cost of capital. A high debt-to-equity ratio might indicate a risky financial structure, especially if the company faces cash flow issues. Conversely, a low ratio may suggest that the company is not leveraging its growth potential effectively.

The Income Statement Analysis

The income statement, or the profit and loss statement, provides a detailed account of a company’s revenues and expenses over a period, culminating in the net profit or loss for that period. It is the most commonly analyzed financial statement as it reflects the company’s operational efficiency. Gross income, found on the income statement, is a critical figure as it indicates the profitability of the core business activities before overhead costs. Analysts also look at trends in various expense categories to assess whether the company is managing costs effectively. A consistent increase in net income over time is a positive sign of growth.

The Cash Flow Statement Analysis

The cash flow statement breaks down the cash generated or used over a period into three activities: operating, investing, and financing. The operating cash flow section is closely tied to the net income on the income statement but adjusts for non-cash transactions, providing a clearer picture of the cash generated from core business operations. Investing activities reflect the company’s capital expenditures and investments, whereas financing activities show how the company raises capital and returns it to shareholders. Sustained positive cash flow from operations is vital for long-term financial health, as it indicates that the company can fund its operations and growth internally.

Interrelation of Financial Statements

The three financial statements are interconnected. The net income from the income statement is the starting point for the cash flow statement, which adjusts for cash and non-cash items to arrive at the cash flow from operations. Changes in balance sheet items, such as accounts receivable or inventory, also impact the cash flow statement. Furthermore, the ending cash balance from the cash flow statement becomes the cash on hand in the balance sheet for the subsequent period. This interrelation allows analysts to cross-verify the data and ensure consistency across the statements.

Financial Ratios and Metrics

Financial ratios calculated from the data in these statements provide additional insights. Liquidity ratios, such as the current ratio and quick ratio, assess a company’s ability to meet short-term obligations. Solvency ratios, like the debt-to-equity ratio, evaluate long-term financial stability. Profitability ratios, including the gross margin and return on equity, measure the company’s ability to generate profits from its assets or equity. Efficiency ratios, such as inventory turnover, indicate how well the company manages its assets. These ratios, when compared with industry averages and historical trends, can highlight strengths and weaknesses in the company’s financial performance.

Conclusion

In conclusion, a thorough analysis of the balance sheet, income statement, and cash flow statement is essential for evaluating a company’s financial status and potential as an investment. The balance sheet gives a snapshot of the company’s financial position, the income statement shows the profitability over time, and the cash flow statement provides insight into the company’s cash generation capabilities. These statements, when analyzed in conjunction, along with financial ratios, offer a comprehensive view of a company’s financial health. By understanding the interplay between these statements and the story they tell, investors can make informed decisions grounded in solid financial evidence.

If you have any questions or feedback, please send us email: contact@kavout.co