MarketLens

Crypto in 2025: Key Trends and Predictions for Bitcoin’s Next Big Moves

The Trump Effect: Regulatory Clarity on the Horizon?

One of the most significant developments in the crypto world is the potential regulatory shift under the Trump administration. Historically, the lack of regulatory clarity has been a major concern for the crypto industry, with the U.S. Securities and Exchange Commission (SEC) often taking a stringent enforcement approach. However, Trump’s administration promises a more crypto-friendly stance, which could be a game-changer.

Pro-Crypto Appointments

Trump’s administration is expected to make key appointments that favor the crypto industry. Notably, Paul Atkins, a known crypto advocate, is poised to lead the SEC. This shift could lead to significant policy changes, providing much-needed clarity and potentially fostering a more accommodating environment for crypto operators. The focus is likely to be on stablecoin legislation initially, followed by a comprehensive bill clarifying the classification of crypto assets.

Strategic Bitcoin Reserve

Another intriguing possibility is the establishment of a U.S. strategic Bitcoin reserve. This concept, akin to national reserves for oil or gold, could legitimize Bitcoin as a strategic asset and trigger global FOMO (fear of missing out). Trump’s suggestion to utilize 200,000 confiscated bitcoins to initiate this reserve underscores the administration’s pro-crypto stance.

Bitcoin Price Predictions: A Bullish Outlook

The optimism surrounding Bitcoin’s future is palpable, with analysts projecting significant price increases. Bitwise analysts predict that Bitcoin could reach $200,000 by the end of 2025, while VanEck estimates a slightly lower target of $180,000. These predictions are underpinned by several key factors.

Institutional Investment Surge

Institutional interest in Bitcoin has surged, with spot Bitcoin ETFs attracting billions in inflows. BlackRock’s iShares Bitcoin Trust alone manages approximately $60 billion, highlighting the growing institutional appetite for Bitcoin. This influx of institutional capital is expected to provide a strong foundation for Bitcoin’s price appreciation.

The Halving Cycle

Bitcoin’s price movements often follow a four-year halving cycle, which reduces the issuance of new coins. The 2024 halving, which cut miners’ block rewards from 6.25 BTC to 3.125 BTC, is anticipated to drive a price rally, as has been observed in previous cycles. This reduction in supply, coupled with increasing demand, creates a favorable environment for price growth.

Market Dynamics and Corrections

While the outlook is bullish, history suggests that the market may be due for a correction. Bitcoin’s price is known for its volatility, and analysts caution that corrections of 20%-40% are possible. However, the presence of large institutional investors may buffer against severe downturns, providing a stabilizing effect on the market.

The Broader Crypto Landscape: Altcoins and Innovations

While Bitcoin remains the focal point, the broader crypto market is also poised for significant developments. Altcoins, stablecoins, and emerging technologies like tokenization and AI integration are expected to play crucial roles in shaping the market.

Altcoin Dynamics

The Bitcoin Dominance Index, which measures Bitcoin’s market share, has reached new highs, indicating a strong position for Bitcoin. However, historically, when Bitcoin exceeds its all-time high, there tends to be a shift toward altcoins. The timing and extent of this shift remain uncertain, but altcoins like Ethereum, Solana, and XRP are well-positioned to benefit from increased interest.

Stablecoin Growth

The stablecoin market is projected to double, reaching a $400 billion cap. Companies like Circle and Stripe are positioning stablecoins as essential components of fintech, emphasizing their speed and low costs. This growth is expected to enhance the overall liquidity and stability of the crypto market.

Tokenization and AI Integration

The tokenization of real-world assets is set to expand dramatically, with the market expected to grow from $2 billion to $2 trillion by 2030. This trend, driven by advantages like lower costs and increased liquidity, could revolutionize the way assets are managed and traded. Additionally, the fusion of AI and crypto is gaining traction, with emerging technologies like AI agents poised to revolutionize user interactions in the crypto space.

Challenges and Considerations

Despite the optimistic outlook, several challenges and considerations remain. The global nature of Bitcoin mining presents logistical and environmental challenges, particularly if efforts are made to concentrate mining operations in the U.S. Additionally, the potential for regulatory overreach and systemic risks associated with increased crypto adoption cannot be ignored.

Federal Reserve Influence

The Federal Reserve’s monetary policy will play a crucial role in shaping Bitcoin’s price trajectory. A dovish stance, maintaining or lowering interest rates, could make cryptocurrencies more attractive, incentivizing investment in riskier assets like Bitcoin. Conversely, a hawkish approach could create a cautious environment for traders and investors.

Market Volatility

Bitcoin’s inherent volatility remains a key consideration. While the long-term outlook is bullish, short-term corrections are likely. Analysts emphasize the importance of maintaining above crucial trend lines to support future price direction. Investors should be prepared for potential market fluctuations and consider strategies like Dollar Cost Averaging to mitigate risks.

Conclusion: A Year of Transformation

As we look ahead to 2025, the Bitcoin and crypto markets are poised for a year of transformation. The combination of regulatory clarity, institutional investment, and technological innovation sets the stage for significant growth and increased legitimacy. While challenges remain, the overall sentiment is optimistic, with Bitcoin expected to reach new heights and the broader crypto market continuing to evolve.

For individual investors, the key takeaway is to stay informed and adaptable. The crypto landscape is dynamic, and understanding the driving factors and potential risks is crucial for making informed investment decisions. As always, diversification and a long-term perspective are essential strategies for navigating the exciting yet volatile world of cryptocurrencies.

In conclusion, 2025 promises to be a pivotal year for Bitcoin and the crypto markets. Whether you’re a seasoned investor or a curious newcomer, staying engaged and informed will be key to capitalizing on the opportunities that lie ahead.

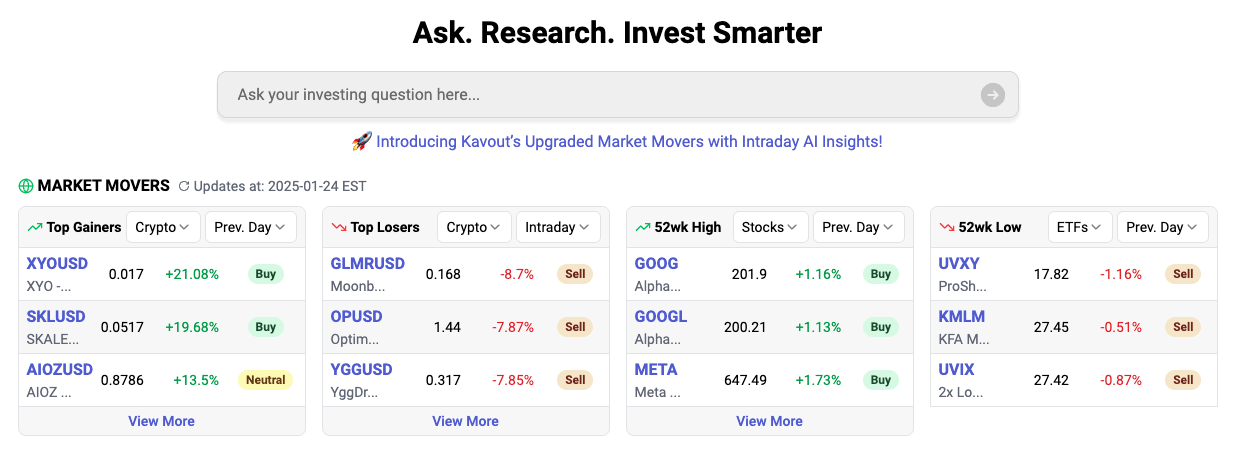

Cryptocurrency Data Now on Kavout!

Cryptocurrency data has officially arrived on Kavout! You can now track hundreds of cryptocurrencies on your Watchlist and run detailed technical analysis on top cryptos like Bitcoin (BTCUSD) and Ethereum (ETHUSD). More features for both cryptos and stocks are coming soon—share your feedback at contact@kavout.co to help us improve.

🎄 Holiday Offer: Save Up to 40%

Celebrate the season with our Holiday Sale! Use code HOLIDAY25 to get 25% OFF all plans and combine it with annual subscription savings for up to 40% OFF. Hurry—this limited-time offer ends January 1, 2025, at midnight!

Related Articles

Category

You may also like

No related articles available

Breaking News

View All →No topics available at the moment