MarketLens

Get Ahead with Early Access: Exploring ETF Technical Analysis Through Diverse Indicators

In the realm of financial markets, Exchange-Traded Funds (ETFs) have become a popular investment vehicle, offering diversification and ease of trading. Technical analysis is a method used to evaluate securities and forecast the direction of prices through the study of past market data, primarily price and volume. This report delves into the technical analysis of various ETFs, employing an array of indicators such as Moving Averages, Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Stochastics, Bollinger Bands, On-Balance Volume (OBV), and Chaikin Money Flow (CMF).

In the dynamic landscape of US exchanges, Exchange-Traded Funds (ETFs) have emerged as vital investment vehicles for numerous investors. As these ETFs continue to play a significant role, understanding their trends is crucial for both investors and traders. Technical indicators are the perfect tools for this, offering insights into the movements of ETFs.

However, the plethora of technical indicators available can be overwhelming, each with its unique strengths. The challenge intensifies when these indicators present conflicting signals, making it difficult even for experts to predict market movements accurately. Recognizing this complexity, we’ve developed innovative methods to analyze these indicators thoroughly. Our comprehensive analysis simplifies the process, empowering you to make more informed and effective investment decisions.

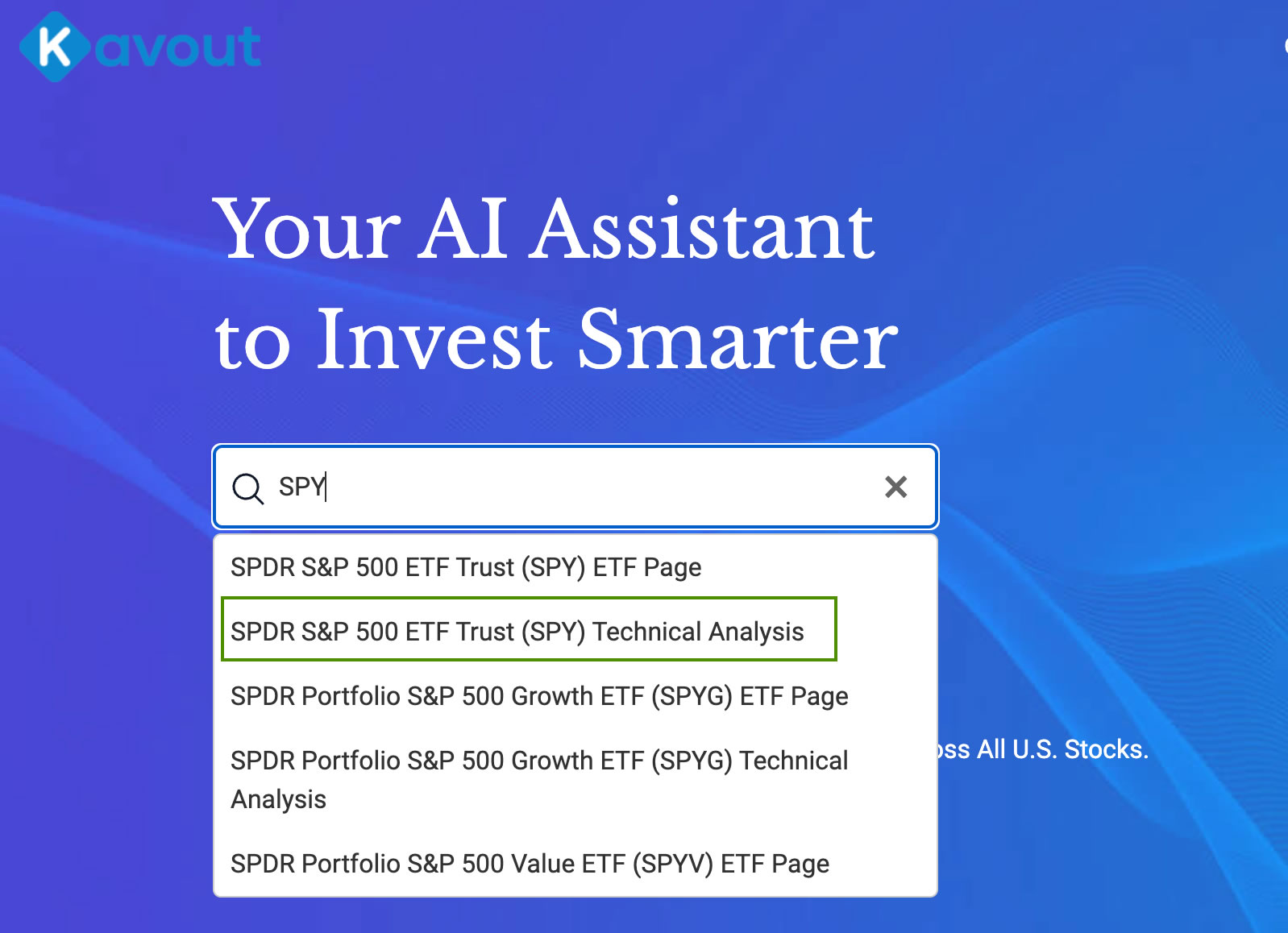

Visit kavout.com and simply enter the ticker symbol of your chosen ETF (now we cover 2,000 most popular ETFs in US exchanges). By selecting ‘Technical Analysis’, you’ll unlock a comprehensive analysis that provides an in-depth look at the ETF’s short-term movements.

Examples:

SPY Technical Analysis QQQ Technical Analysis

Moving Averages (MA)

Moving averages smooth out price data to form a trend-following indicator that is fundamental in technical analysis. The commonly used Exponential Moving Averages (EMAs) of 12 and 26 periods are particularly significant when applied to the MACD indicator. For instance, the 5-day MA of the Schwab US Dividend Equity ETF (SCHD) has been hovering around the $76.95 mark, suggesting a stable short-term trend (Kavout).

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. An RSI above 70 typically indicates that a security is overbought, while an RSI below 30 indicates oversold conditions. ETFs like the Invesco BulletShares 2024 High Yield Corporate Bond ETF (BSJO) have shown mixed signals with RSI in the overbought zone, potentially signaling a pullback (Kavout).

Moving Average Convergence Divergence (MACD)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. The Simplify US Equity PLUS Downside Convexity ETF (SPD) has been analyzed with MACD to gauge market dynamics (Kavout).

Stochastics

Stochastics are a momentum indicator comparing a particular closing price of a security to a range of its prices over a certain period. It follows the speed or the momentum of price. As a rule of thumb, a stochastic reading above 80 indicates that the security is overbought, whereas a reading below 20 indicates oversold conditions.

Bollinger Bands

Bollinger Bands are volatility bands placed above and below a moving average. Volatility is based on the standard deviation, which changes as volatility increases or decreases. A widening of the bands suggests increased market volatility. For instance, the ProShares Pet Care ETF (PAWZ) has been analyzed using Bollinger Bands to determine potential price movements (Kavout).

On-Balance Volume (OBV)

OBV is a technical trading momentum indicator that uses volume flow to predict changes in stock price. The theory is that volume precedes price movement, so if a security is seeing an increasing OBV, it is generally considered bullish; if the OBV is falling, the price is likely to follow.

Chaikin Money Flow (CMF)

The CMF combines price and volume to measure the buying and selling pressure for a given period. A positive CMF would indicate buying pressure, while a negative CMF indicates selling pressure. This can be a useful confirmation of a trend suggested by other indicators.

Analysis and Opinion

Upon reviewing the technical indicators for various ETFs, a pattern emerges that suggests a cautious approach to the market. The moving averages, particularly the EMA, have provided insights into the short-term trends of ETFs like SCHD and SPD. The stability in the short-term trend of SCHD, as indicated by its 5-day MA, may attract investors looking for less volatility (Kavout).

The RSI and Stochastic indicators have shown mixed signals across different ETFs. The overbought RSI readings for BSJO suggest that the ETF could be due for a correction or pullback, which is a common interpretation when such momentum indicators reach extreme levels (Kavout). Conversely, if the Stochastics indicator is pointing to oversold conditions, investors might anticipate a potential rebound.

The MACD, a key indicator for trend-following traders, has been instrumental in analyzing the market dynamics of ETFs like SPD. Traders often look for the crossover of the MACD line and signal line to identify potential buy or sell opportunities. Bollinger Bands have indicated increased volatility in ETFs such as PAWZ, which could be a precursor to significant price movements (Kavout).

Volume indicators like OBV and CMF have not been explicitly discussed in the provided sources, but they are essential to confirm the strength of a trend. An increasing OBV or positive CMF would lend more credibility to a bullish trend, while the opposite would suggest caution.

In conclusion, the ETF market presents a nuanced picture according to the technical indicators analyzed. While some ETFs show stability and bullish trends, others indicate overbought conditions that could result in a downturn. Investors should use these indicators in conjunction with each other to form a comprehensive view of the market and make informed decisions. It is essential to remember that technical analysis is not foolproof and should be used in the context of a broader investment strategy.

If you have any questions or feedback, please send us email: contact@kavout.co

Related Articles

2025’s Top Sectors: Your Savvy ETF Guide

Category

You may also like

No related articles available

Breaking News

View All →No topics available at the moment