MarketLens

IBM: The Prospects of AI Benefiting the Stock in 2024

International Business Machines Corporation (IBM) has been a cornerstone of the technology sector for over a century. With the advent of cloud computing and artificial intelligence (AI), IBM has strategically pivoted to leverage these technologies to ensure its continued relevance and growth. The question at hand is whether AI will benefit IBM’s stock in 2024 and how analysts perceive the company’s position in the market.

IBM’s AI and Cloud Computing Trajectory

IBM has been doubling down on its AI and cloud computing capabilities, with a particular focus on the nascent field of quantum computing. The company’s AI solutions, such as Watson, have been integrated across various industries, aiding businesses in predicting and shaping future outcomes, as well as automating complex processes. This technological advancement could be a significant growth driver for IBM, as AI’s applicability has the potential to transform business processes across many sectors.

Under the leadership of CEO Arvind Krishna, who took the helm in 2020, IBM has undergone a transformation, focusing on high-margin cloud computing and AI markets. This shift has emphasized IBM’s strong free cash flow generation, which is a positive indicator for the stock’s long-term income potential.

Financial Performance and Dividend Reliability

A key factor that investors often consider is the financial stability of a company. IBM has not only shown growth in its AI and cloud segments but also offers a reliable dividend, which has been a consistent payout for 28 years. This aspect of the stock makes it an attractive option for income-focused investors, especially when considering the long-term horizon of 2024 and beyond.

Analysts’ Views and Market Comparisons

While IBM’s profitability and governance in AI, exemplified by its WatsonX platform, have been recognized, analysts have shown more enthusiasm for competitors like Microsoft, predicting a significant addition to Microsoft’s topline by 2025 due to its AI growth story. Despite this, IBM’s AI expertise and consulting capabilities are expected to prosper, which could potentially undervalue IBM’s stock in the eyes of investors who may be swayed by the more prominent narrative around Microsoft’s AI prospects.

The Role of AI in IBM’s Future

IBM sees AI as a transformative force for its clients, with three high-impact use cases and over a dozen additional cases being explored. The company’s AI strategy and the results it has garnered from customers suggest that IBM is well-positioned to capitalize on the AI wave. However, it’s important to note that while IBM has been vocal about its AI capabilities, investors should focus on the broader picture, including earnings and overall business performance.

Conclusion

Based on the provided information, it is my opinion that AI will indeed benefit IBM’s stock in 2024. The company’s strategic focus on AI and cloud computing, its strong free cash flow generation, and its commitment to dividends present a compelling case for IBM as a worthwhile long-term investment. While analysts may currently favor other tech giants for their AI growth stories, IBM’s deep expertise and broad application of AI across industries should not be underestimated.

IBM’s stock appears to be positioned for growth, driven by its AI initiatives. The company’s alignment with market demands and its ability to innovate in the AI space are likely to contribute positively to its stock performance in 2024. Investors looking for a stable tech stock with growth potential in AI and cloud computing would do well to consider IBM as part of their portfolio.

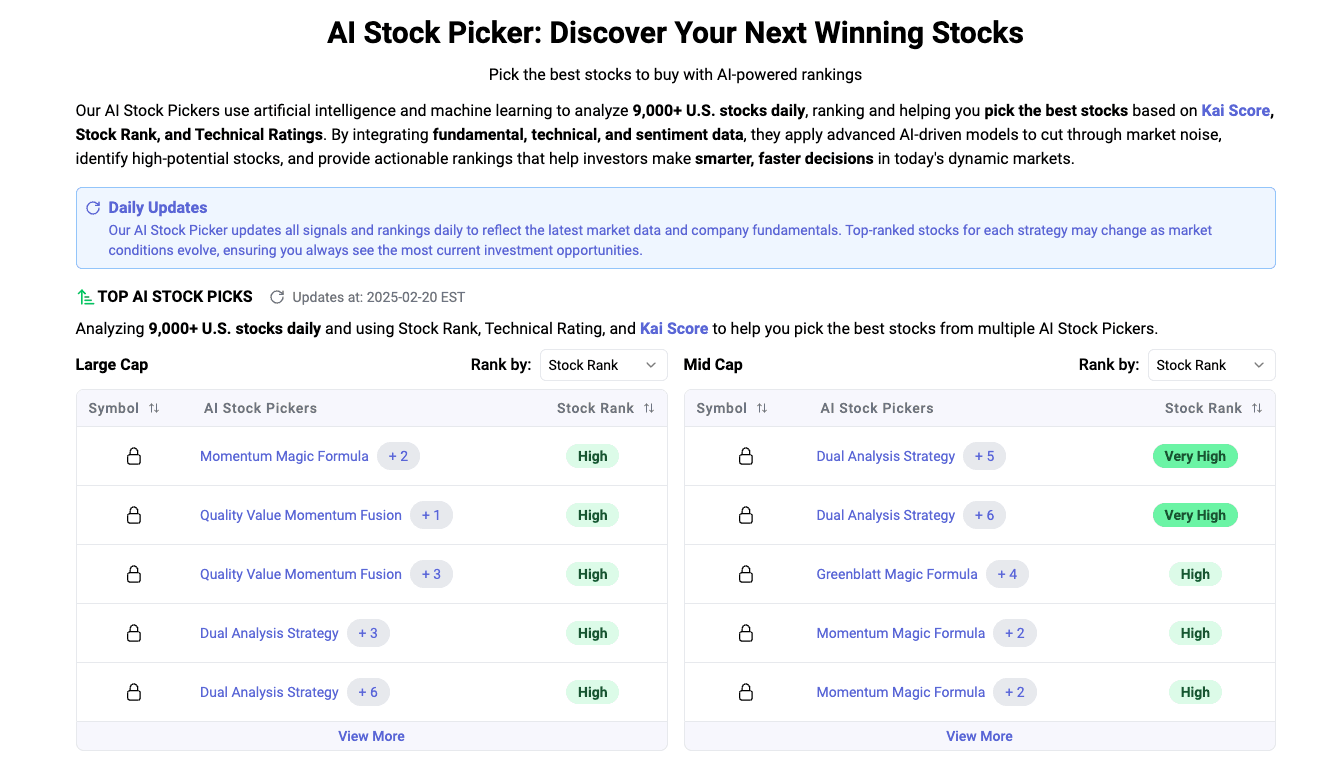

To become a better investor with our AI Assistant @ kavout.com/investgpt

Related Articles

Category

You may also like

No related articles available

Breaking News

View All →No topics available at the moment