Introducing DocuQuest: Kavout’s Innovative Tool for Investor Due Diligence

When you’re an investor or an analyst, it can be crucial to get reliable, actionable information when evaluating a stock or a company to invest in. Of course, the sheer amount of publicly available information about any company – not to mention reporting delays and communication preferences of individual companies – can be daunting. Kavout, a premier provider of AI-powered investment research solutions, is happy to announce a new product to help extract valuable insight from a sea of corporate documents.

DocuQuest exploits large data science technologies – such as writing-style natural language processing and machine learning – that, when applied to a company’s financial filings with the Securities and Exchange Commission, along with press releases and other company documents, a client can ask increasingly richer questions and, in return, receive more precise answers to their questions. Investors who use DocuQuest spend less time laboring through due diligence and, as a consequence, can find more investments.

Some example questions that investors could ask with DocuQuest:

- Apple (AAPL): What is Apple’s product revenue distribution in the 2023 10-K?

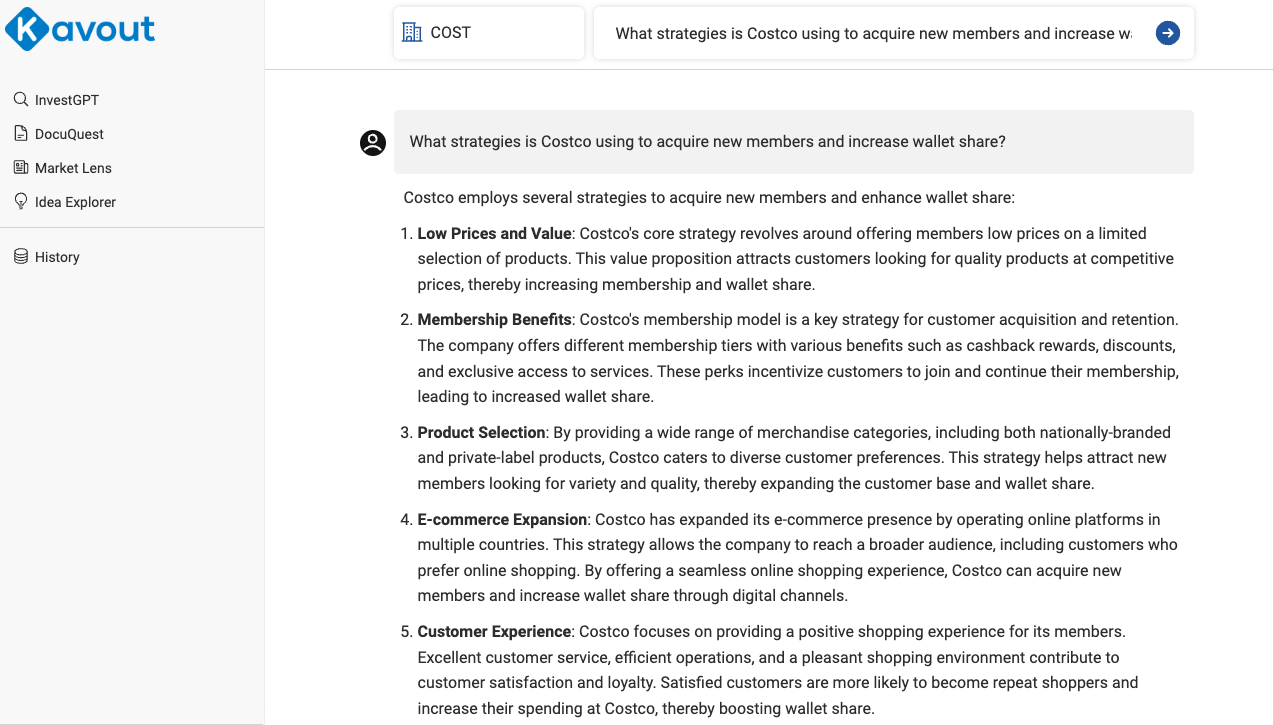

- Costco (COST): How is the retailer growing its member base and wallet share?

- DASH (DoorDash): What makes DoorDash different (ie, services, pricing and logistics capabilities) and how?

- Google (GOOGL): How does Google improve its ad tech and how does it compete with other adtech rivals?

- Microsoft (MSFT): How does Azure’s growth, market share and development roadmap compare with AWS and Google Cloud?

Thanks to DocuQuest, an investor gets answers to these questions and many others, freeing him or her to make decisions well-informed by real data. DocuQuest’s user-friendly, intuitive interface and powerful search capabilities make a company’s financial research just a click away for even the most inexperienced investor.

Furthermore, DocuQuest has been used not only by individual investors but also by investment firms, financial advisors and analysts. This is because DocuQuest frees up analysts’ time that can now be more efficiently spent on analysis instead of research tasks, letting them turn data into insights and insights into investment strategies.

To learn more about DocuQuest and how it can transform your investment research process, please visit Kavout’s website.