MarketLens

Mastering Stock Analysis: Key Investment Checklist Questions for Evaluating Stocks, Industries, and Competitors

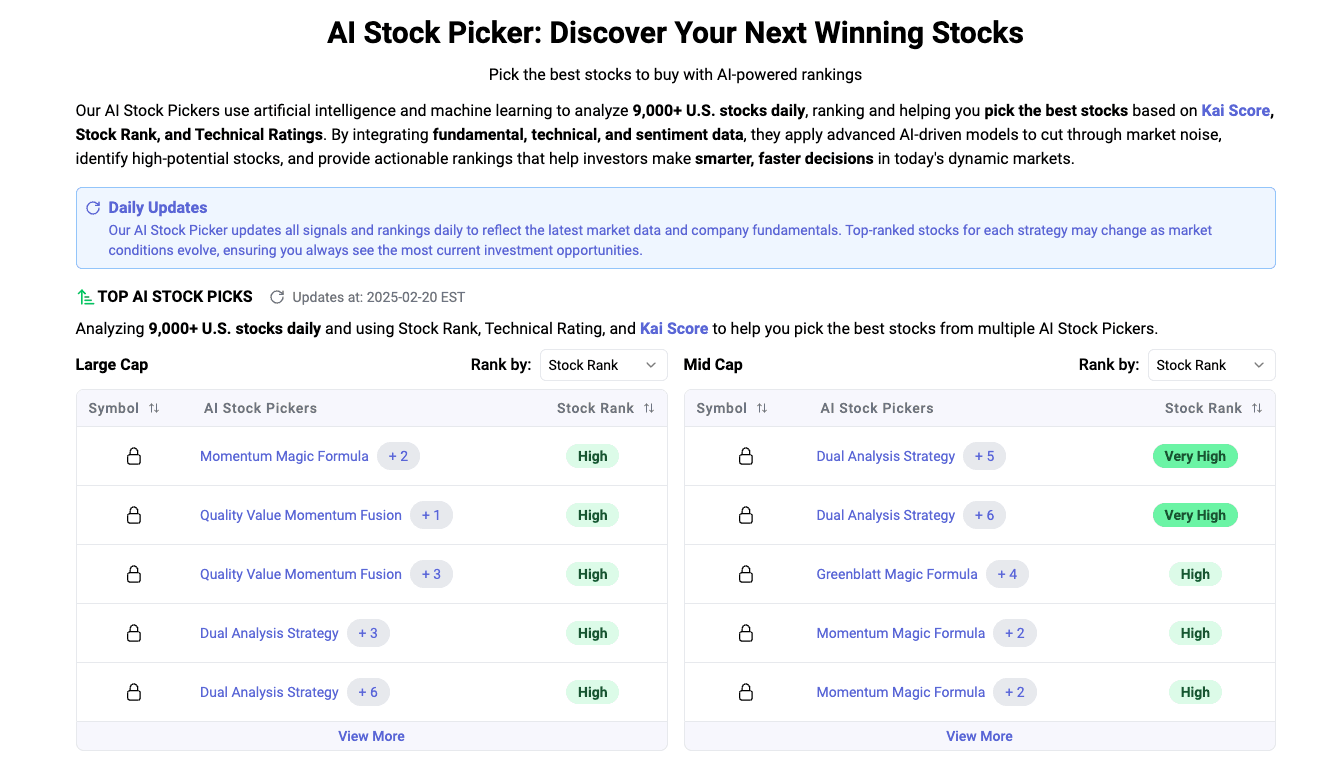

Creating an investment checklist is an excellent approach to systematically analyze stocks, their respective industries, and competitors.

As an illustration, we are going to use Costco (COST), the US retail giant as our example to try AI assistant Kavout Chat to analyze the stock. Here’s a set of key questions to consider for each area:

Stock Analysis Checklist

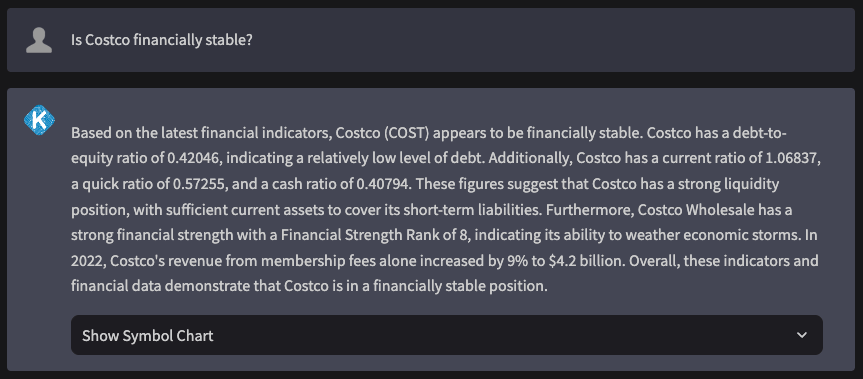

Financial Health: Is the company financially stable?

As shown above: Based on the latest financial indicators, Costco (COST) appears to be financially stable. Costco has a debt-to-equity ratio of 0.42046, indicating a relatively low level of debt. Additionally, Costco has a current ratio of 1.06837, a quick ratio of 0.57255, and a cash ratio of 0.40794. These figures suggest that Costco has a strong liquidity position, with sufficient current assets to cover its short-term liabilities. Furthermore, Costco Wholesale has a strong financial strength with a Financial Strength Rank of 8, indicating its ability to weather economic storms. In 2022, Costco’s revenue from membership fees alone increased by 9% to $4.2 billion. Overall, these indicators and financial data demonstrate that Costco is in a financially stable position.

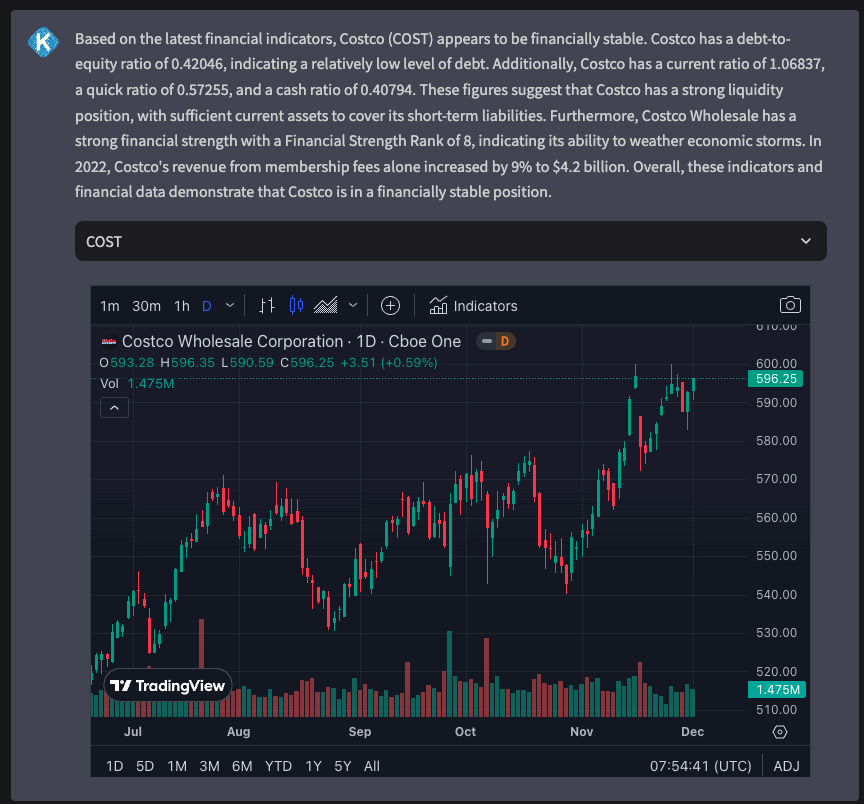

As illustrated in the image, Kavout Chat now integrates stock charts directly into each response. This allows you to view stock price trends and conduct technical analysis seamlessly, all within the chat interface.

Just click the drop down menu: Show Symbol Chart, you will receive an amazing candle chart with indicators.

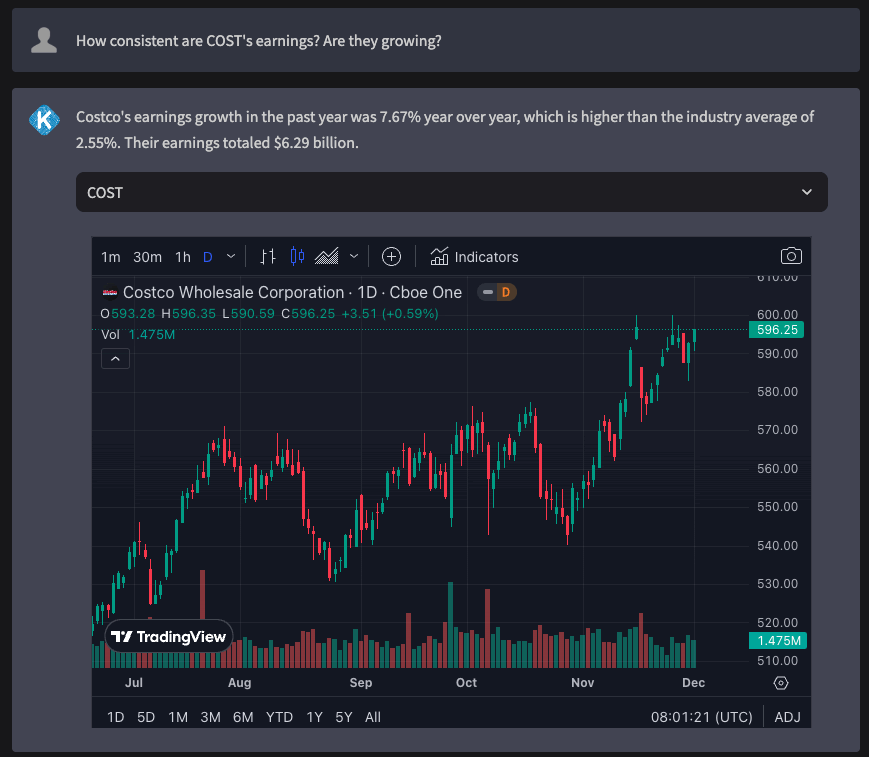

Earnings Performance: How consistent are the company’s earnings?

Management and Governance: Is the company well-managed? Does it have a history of ethical and effective leadership?

Valuation: Is the stock fairly valued?

For all the following questions, you could substitute the company with your stock symbol or company name, here is COST, and try these questions at Kavout Chat to do your stock research.

Growth Potential: What are the company’s prospects for future growth? Are there clear strategies for growth and expansion?

Risks and Challenges: What risks and challenges does the company face? How does it manage these risks?

Innovation and Adaptation: Is the company innovative? Does it adapt well to industry changes and technological advancements?

Market Position: How does the company rank in its sector? Is it a leader or a follower?

Industry Analysis Checklist

- Industry Trends: What are the current and emerging trends in the industry?

- Regulatory Environment: Are there any regulatory changes that could impact the industry?

- Market Size and Growth: How large is the industry, and at what rate is it growing?

- Cyclical or Defensive: Is the industry cyclical or defensive (less impacted by economic cycles)?

- Competitive Landscape: How competitive is the industry? Is it fragmented or dominated by a few players?

- Technological Changes: Is the industry subject to rapid technological change or disruption?

- Supply and Demand Dynamics: What are the supply and demand dynamics in the industry?

Competitor Analysis Checklist

- Market Share: What is each competitor’s market share in the industry?

- Competitive Advantages: What competitive advantages do the competitors hold?

- Financial Comparison: How do the competitors’ financials compare?.

- Product/Service Differentiation: How do competitors’ products/services differ from the company’s?

- Management Quality: What is the quality of management in competing firms?

- Strategic Initiatives: What strategic initiatives are competitors undertaking? Are they expanding, innovating, or entering new markets?

- Vulnerabilities: What are the competitors’ weaknesses or vulnerabilities?

A comprehensive analysis using these checklists can provide a well-rounded view of a stock, its industry, and its competitive landscape. This approach helps in making informed and balanced investment decisions.

To become a better investor with our AI Assistant @ kavout.com/investgpt

Related Articles

Category

You may also like

No related articles available

Breaking News

View All →No topics available at the moment