Partnership Portfolios

Grounded in tried-and-true principles, supercharged with machine learning.

Kavout has developed model portfolios backed by research.

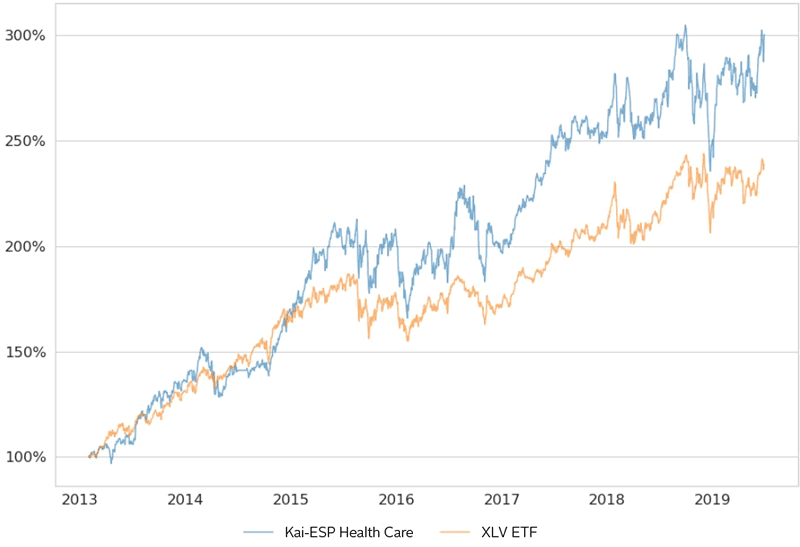

Figure: The Health Care Kai Enhanced Sector Portfolio (Kai-ESP) has consistently outperformed the XLV ETF since 2013

Health Care Kai Enhanced Sector Portfolio (Monthly Rebalance)

The US Health Care sector is one of the largest and most complex in the US economy, accounting for 17.1% of the overall GDP in 2017. For investors, the complex nature of the Health Care sector is attractive.

To build our portfolio, we screen stocks within a sector to select the best stocks according to K Score – output of Quantamental analytics and machine learning models.

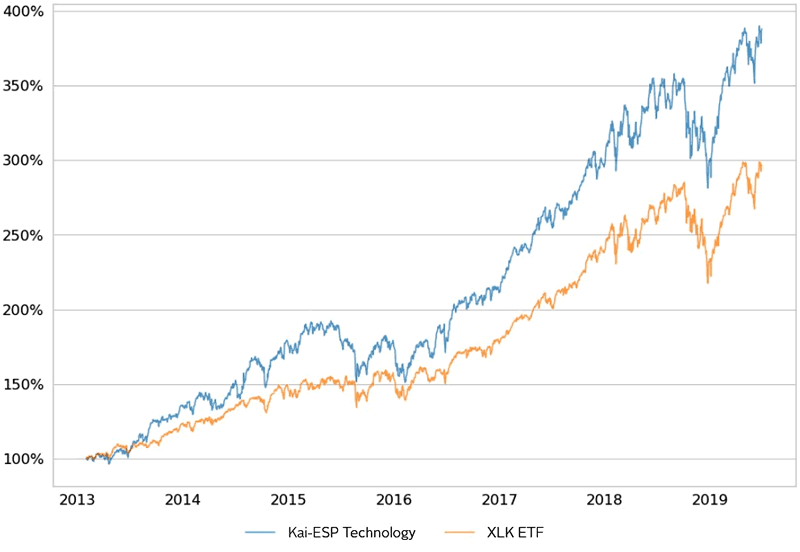

Figure: The Technology Kai-ESP has consistently outperformed the XLK ETF since 2013

Technology Kai Enhanced Sector Portfolio

Technology effects every sector in the modern economy, with companies consistently seeking to improve quality, productivity, and/or profitability. In addition to being the single largest segment of the market, it is extremely fast moving.

We benchmark this US portfolio against the industry leading ETF (XLK) and screen stocks within the US technology sector based on K Score.

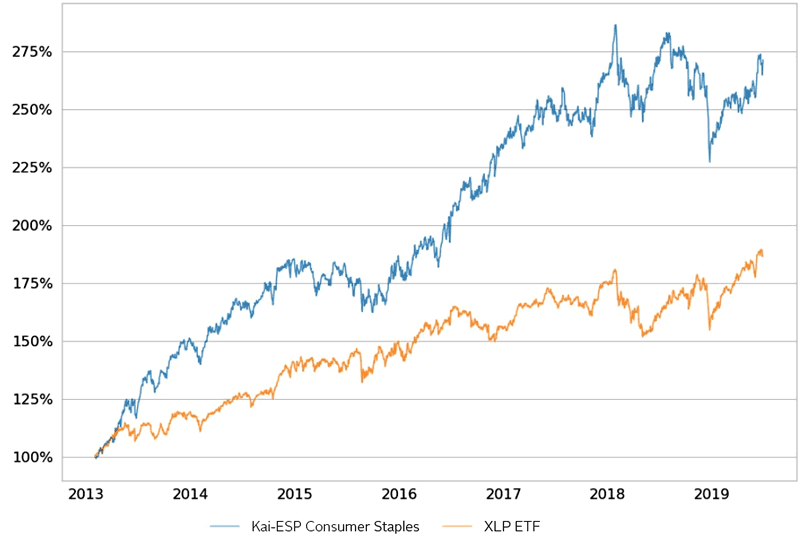

Figure: The Consumer Staples Kai-ESP has consistently outperformed the XLP ETF since 2013

Consumer Staples Kai Enhanced Sector Portfolio

The Consumer Staples sector includes vendors that produce products or services that are essential for daily living, and a major part of most consumers’ monthly budgets.

This portfolio gives full sector exposure in the US and concentrates on the stocks with the highest potential. To seek maximum risk-adjusted returns the portfolio strategy is rebalanced and asset allocation is optimized for both holdings and weights.

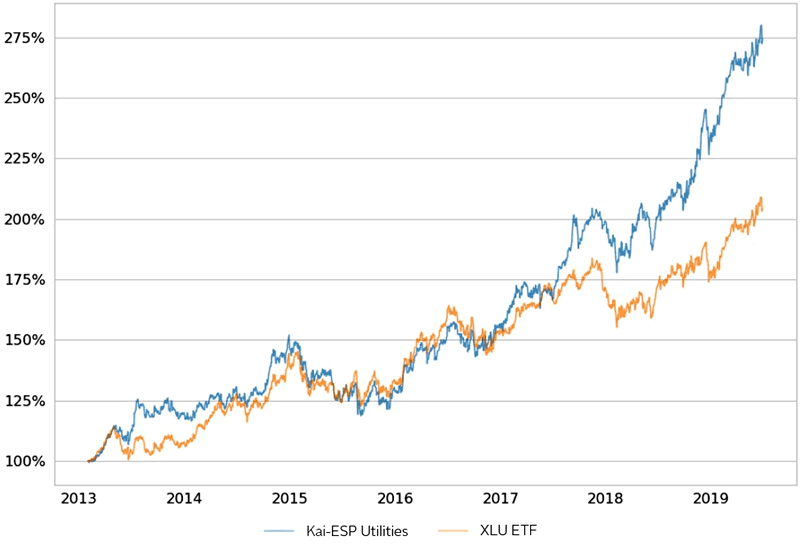

Figure: The Utilities Kai-ESP has consistently outperformed the sector ETF (XLU) since 2013

Utilities Kai Enhanced Sector Portfolio

The Utilities sector include those companies that provide the basic amenities: water, sewage services, electricity, dams, and natural gas. This sector includes public service which can be highly regulated.

Stocks are selected from the US K Scores universe, and enhanced with machine learning ranking methodology. Risk-adjusted returns are rebalanced and asset allocation optimized for both holdings and weights.

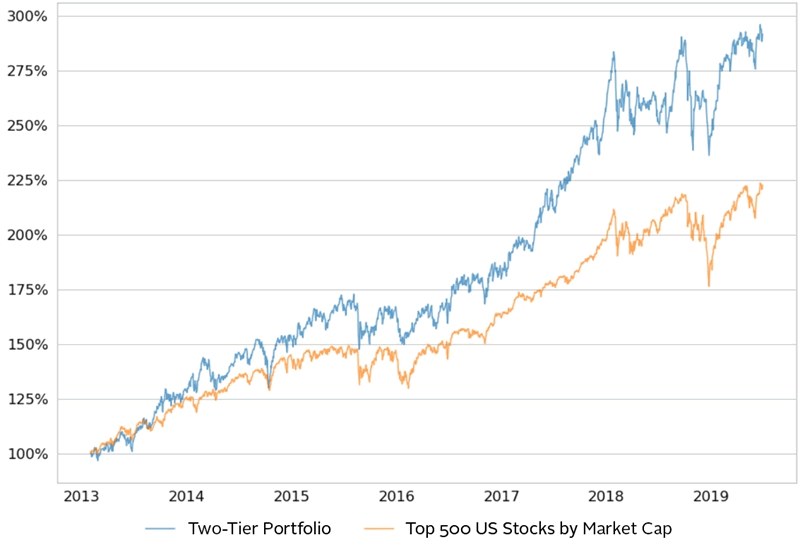

Figure: Two-tier Tactical Asset Allocation portfolio has significantly outperformed the benchmark SPY since 2014

Two-tier Tactical Asset Allocation

Our Kai engine dynamically selects top stocks from multiple sectors based on price momentums, volatilities, correlations, and other factors. Stocks have to go through several rounds of comparison and selection in order to be included in the portfolio.

We analyze hundreds of US stocks included in major ETFs and adjust our results. This ensures a balanced exposure between top-quality assets that ride on short-term momentum and assets that seek long-term growth.

Contact us

Contact us today to learn more about Kavout's products or services.