Quality Value Momentum Fusion Strategy: Outperforming the S&P 500 by 90% in Penny Stocks for September

In the fast-paced world of investing, identifying penny stocks that offer the right balance between growth potential, financial stability, and market momentum can be a daunting task. However, the Quality Value Momentum Fusion strategy, specifically tailored to penny stocks, continues to prove its effectiveness by combining three key factors—quality, value, and momentum—into a powerful stock-picking approach.

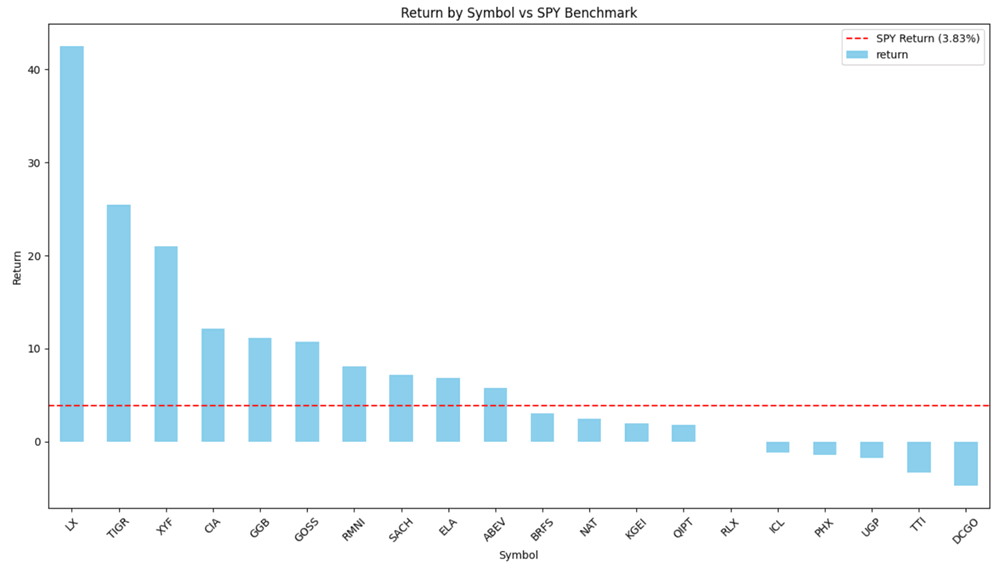

In September, our strategy focused on penny stocks delivered a remarkable average return of 7.38%, surpassing the S&P 500’s return of 3.83% by over 90%. Let’s dive into how the fusion of these three critical factors helped us achieve this outperformance and the key insights you can take away to power your portfolio.

The Strategy at a Glance

The Quality Value Momentum Fusion strategy is designed to blend strong fundamentals (quality), attractive valuations (value), and upward price trends (momentum) to target penny stocks with both short-term upside and long-term stability. By balancing these three dimensions, we aim to create a portfolio that captures growth while mitigating risk, especially in the often volatile penny stock space.

September Performance Highlights

- LX was the star performer in September, with an astonishing return of 42.53%, driven by solid upward momentum and financial health. Its trend price metric indicated a consistent upward price trend, while the quality score showed strong fundamentals.

- TIGR followed closely with a 25.48% return, proving that stocks with a solid quality score and momentum signal can generate outsized gains even in penny stock territory.

- Overall, more than 80% of the stocks in the portfolio outperformed the S&P 500 benchmark return of 3.83%, with several stocks like XYF, CIA, and GGB posting double-digit gains.

- Even stocks with slightly lower quality scores, such as RMNI and SACH, delivered solid returns, highlighting how momentum plays a key role in short-term performance.

What Made the Difference?

The success of the Quality Value Momentum Fusion strategy lies in its ability to:

- Identify financially sound stocks: By using the quality score, the strategy filters out stocks that may be fundamentally weak, thus reducing downside risk.

- Capture undervalued opportunities: The value component ensures that the penny stocks picked are attractively priced relative to their financials, helping investors buy into strong companies at a discount.

- Leverage price momentum: The momentum factor allows the strategy to ride the wave of stocks that are gaining upward traction in the market, enabling short-term profits.

Underperformers and Lessons Learned

As with any investment strategy, not every stock will outperform. Stocks like PHX and ICL delivered negative returns, showcasing the volatility inherent in the penny stock space. However, these underperformers were in the minority, and the diversified approach of the strategy helped mitigate their impact on the overall portfolio.

How to Use the Quality Value Momentum Fusion Strategy

The Quality Value Momentum Fusion strategy combines three key factors—quality, value, and momentum—to help you find stocks with strong fundamentals, attractive valuations, and positive price trends. Here’s how to maximize its benefits using InvestGPT:

- Stock Picker as Your Foundation: The stocks in the Quality Value Momentum Fusion pool are already filtered for high quality, value, and upward momentum. InvestGPT can help you dive deeper into these stocks by checking their financial information, running in-depth technical and stock analysis, and comparing them to others in the market.

- Conduct Your Own Research: Once you’ve identified potential stocks, you can use InvestGPT and other tools to review earnings reports, assess company management, and evaluate industry trends. InvestGPT allows you to run more complex analyses, including checking analysts’ opinions and comparing stocks side by side by asking questions.

- Use Momentum for Entry Timing: Leverage momentum data provided by the strategy and use InvestGPT to further refine your timing, ensuring you’re buying and selling at the most opportune moments.

By using the Quality Value Momentum Fusion strategy with InvestGPT, you can efficiently generate stock ideas, perform thorough financial analysis, and make informed investment decisions backed by comprehensive data and insights.

Unlock More with InvestGPT Pro

In addition to the Quality Value Momentum Fusion Strategy, the InvestGPT Pro plan offers access to 12+ AI Stock Picker strategies, each designed to help you generate high-quality stock trade ideas. These strategies are powered by cutting-edge AI and are tailored to different investing styles, allowing you to explore a wide range of opportunities and make more informed trading decisions. With these tools, you can diversify your portfolio and gain deeper insights into market trends—all within the Pro plan.

Conclusion

September’s performance of the Quality Value Momentum Fusion strategy clearly demonstrates its ability to outperform the market, particularly in volatile penny stocks. With an average return of 7.38%, it beat the S&P 500 by more than 90%, proving that a well-balanced strategy can deliver significant gains while managing risk.

As we move into the final quarter of the year, the Quality Value Momentum Fusion strategy remains a powerful approach for those looking to stay ahead of market trends, especially in the fast-moving world of penny stocks.

Call to Action:

Subscribe to InvestGPT Pro today and discover how the Quality Value Momentum Fusion Strategy helps you get the best of both fundamental and technical insights for smarter stock selection. Explore the full suite of AI Stock Picker strategies and supercharge your investment decisions.