MarketLens

Dual Analysis Strategy: Achieve 34% Higher Returns in September by Leveraging Both Fundamental and Technical Insights

I. Maximize Stock Potential with a Powerful Dual-Analysis Strategy

By leveraging these two essential analyses, the Dual Analysis Strategy offers an approach that helps you stay ahead of market trends, targeting stocks that are both fundamentally solid and technically strong.

What is the Dual Analysis Strategy?

At the heart of the Dual Analysis Strategy is a combination of:

- Stock Rank: InvestGPT’s system that evaluates stocks across critical metrics, including:

- Quality: Measuring financial health and profitability.

- Value: Identifying undervalued stocks with solid long-term potential.

- Momentum: Highlighting stocks with positive price trends.

- Technical Ratings: This strategy incorporates widely used technical indicators like moving averages, RSI, and Bollinger Bands, helping you confirm if a stock’s price action aligns with its underlying financial strength. This pairing ensures you’re choosing stocks with both strong fundamentals and the right market signals for growth.

II. Outperformance in Action: Dual Analysis Strategy vs. SPY Benchmark in September

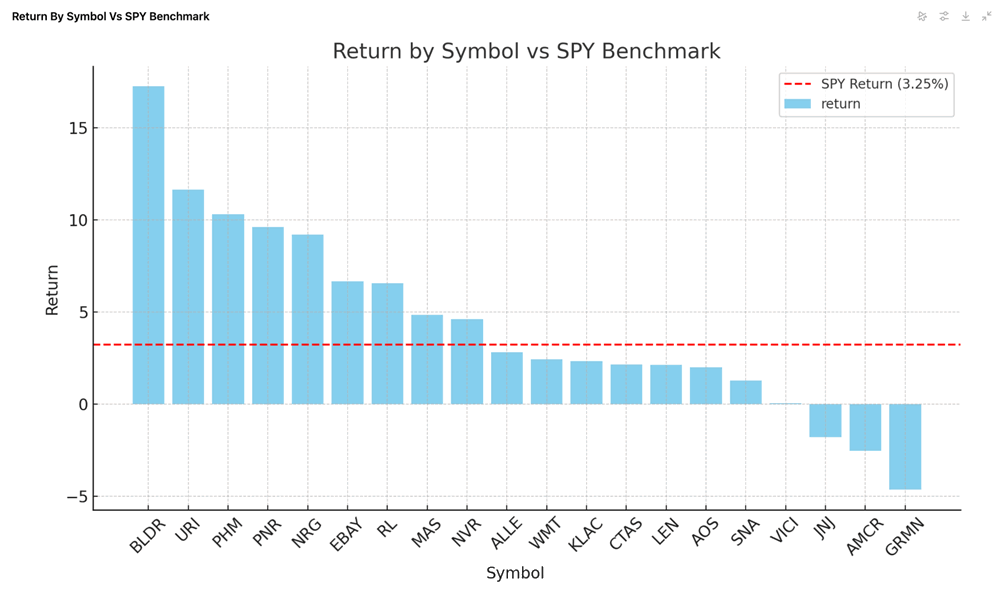

Throughout September, the stock picker by Dual Analysis Strategy on September 1 has delivered 34% higher returns compared to the SPY. The chart below demonstrates the performance of the top 20 stocks selected by the strategy, clearly illustrating how these stocks have significantly outpaced the broader market.

For example, BLDR has achieved a 17.25% return this month to date, far surpassing the SPY’s 3.25% return. Other notable performers include URI with 11.65% and PHM at 10.31%—all significantly outperforming the market and proving the strategy’s strength.

This performance is made possible by using both fundamental analysis to ensure financial stability and technical analysis to capture price momentum, allowing investors to make data-backed decisions and enhance returns.

How to Use the Dual Analysis Strategy

The Dual Analysis Strategy is designed to give you a list of stock ideas based on a combination of fundamental and technical analysis. Here’s how you can use it to enhance your investment decisions:

- Stock Picker as a Starting Point: The stocks displayed in the strategy’s stock pool represent opportunities that have been filtered based on their strong fundamentals and favorable technical indicators.

- Narrow Down Your Ideas: Once you’ve identified potential stocks from the stock picker, run your own detailed analysis. This might include reviewing earnings reports, assessing company management, or evaluating market conditions specific to the stock.

- Use Technical Analysis for Timing: After you’ve analyzed the fundamentals, refer to the technical indicators provided by the strategy to time your entry and exit points. This ensures that you’re not only investing in fundamentally strong companies but also making the most of short-term price trends.

By leveraging the Dual Analysis Strategy, you can efficiently generate stock ideas, backed by data, and refine your selections based on deeper personal analysis and timing considerations.

III. Why Choose the Dual Analysis Strategy?

- Superior Returns in September to Date: The 34% outperformance of the strategy demonstrates how combining fundamental and technical analysis allows you to capture stocks with strong financials and the momentum to grow in the short term.

- Reduce Risk, Enhance Gains: While the Stock Rank ensures you’re investing in fundamentally strong companies, technical signals help you enter the market at the right time, reducing exposure to underperforming stocks and maximizing growth opportunities.

- Real-Time Market Alignment: The integration of real-time technical data ensures your investments stay aligned with market movements, giving you a decisive edge in fast-changing conditions.

IV. Invest Smarter with the Dual Analysis Strategy

Whether you’re a long-term investor seeking steady growth or a trader looking for short-term gains, the Dual Analysis Strategy equips you with the tools to outperform the market. By capitalizing on fundamental strength and technical momentum, this strategy gives you the advantage to make smarter, more informed decisions.

In addition to the Dual Analysis Strategy, the InvestGPT Pro plan offers access to 12+ AI Stock Picker strategies, each designed to help you generate high-quality stock trade ideas. These strategies are powered by cutting-edge AI and are tailored to different investing styles, allowing you to explore a wide range of opportunities and make more informed trading decisions. With these tools, you can diversify your portfolio and gain deeper insights into market trends—all within the Pro plan.

Call to Action:

Subscribe to InvestGPT Pro today and discover how the Dual Analysis Strategy helps you get the best of both fundamental and technical insights for smarter stock selection.

Related Articles

Category

You may also like

No related articles available

Breaking News

View All →No topics available at the moment