MarketLens

The Union of Saks Fifth Avenue and Neiman Marcus: Elevating the Luxury Retail Landscape

The merger of Saks Fifth Avenue and Neiman Marcus, two titans of the luxury retail market, is poised to significantly elevate the luxury retail landscape by leveraging synergies in cost savings, digital strategy, and vendor negotiations. However, this consolidation also brings potential challenges, including regulatory scrutiny, reduced competition, and operational hurdles. This report delves into the multifaceted implications of this merger, considering recent market trends and stakeholder impacts as of July, 2024.

Strategic Benefits of the Merger

Cost Savings and Operational Efficiency

One of the primary strategic benefits of the merger is the potential for substantial cost savings and enhanced operational efficiency. By centralizing administrative functions and streamlining operations, the combined entity, Saks Global, can reduce redundancies and lower operating costs. This centralization is expected to lead to significant economies of scale, allowing the new company to operate more efficiently and effectively.

Moreover, the merger will enable Saks Global to optimize its real estate portfolio, which includes $7 billion in retail assets. By consolidating weaker stores and focusing on more productive locations, the company can maximize its retail footprint and improve overall profitability. This strategic realignment is crucial in a market where physical retail spaces are increasingly under pressure from online shopping trends.

Unified Digital Strategy

The merger also presents an opportunity to create a unified digital strategy, tapping into the growing trend of online luxury shopping. With Amazon and Salesforce as minority shareholders, Saks Global can leverage advanced technology and logistics support to enhance its e-commerce capabilities. This partnership aims to provide a seamless and personalized shopping experience, integrating artificial intelligence to tailor offerings to individual customer preferences.

The involvement of Amazon, in particular, brings significant technological expertise and logistical prowess to the table. This collaboration can help Saks Global compete more effectively with e-commerce giants and luxury brands that are increasingly focusing on direct-to-consumer sales. By enhancing its digital presence, Saks Global can attract a broader demographic, including younger, tech-savvy consumers who prefer online shopping.

Potential Downsides and Challenges

Regulatory Scrutiny and Antitrust Concerns

Despite the strategic benefits, the merger is likely to face tough scrutiny from federal regulators. The Federal Trade Commission (FTC) and the antitrust division of the Justice Department have recently blocked several high-profile deals between market leaders, citing concerns about reduced competition and higher prices. The merger of Saks Fifth Avenue and Neiman Marcus could be perceived as reducing competition in the luxury retail market, potentially leading to higher prices and fewer choices for consumers.

The FTC’s recent actions, such as blocking the Tapestry Inc. deal to buy Capri Holdings, highlight the regulatory challenges that Saks Global may face. The combined entity’s increased negotiating power with vendors and potential pressure on smaller brands could also raise antitrust concerns. Regulatory approval is not guaranteed, and the merger’s success hinges on navigating these legal and regulatory hurdles.

Operational Challenges and Store Closures

Another significant challenge is the potential for operational disruptions, including store closures and job losses. While the merger aims to optimize the retail footprint, this process may involve closing underperforming stores, leading to job losses and negative impacts on local economies. The historical precedent of retail mergers, such as the Macy’s acquisition of May Co. and the Sears-Kmart merger, underscores the risks of operational challenges and the potential for long-term negative outcomes.

Moreover, integrating two distinct corporate cultures and operational systems can be complex and fraught with difficulties. Ensuring a smooth transition and maintaining high levels of customer service during the integration process will be critical to the merger’s success. Any decline in customer service could erode brand loyalty and negatively impact the combined entity’s reputation.

Market Trends and Consumer Behavior

Shift to Online Shopping and Direct-to-Consumer Sales

The luxury retail market has been undergoing significant changes, with a notable shift towards online shopping and direct-to-consumer sales. Luxury brands are increasingly bypassing department stores and connecting directly with shoppers through their own retail locations and online platforms. This trend poses a challenge for traditional department stores like Saks Fifth Avenue and Neiman Marcus, which must adapt to changing consumer preferences.

The pandemic accelerated the shift to online shopping, and while the luxury shopping spree has cooled, the preference for online purchases remains strong. Saks Global’s focus on enhancing its digital strategy and leveraging Amazon’s technological expertise is a strategic move to address this trend. However, the combined entity must continue to innovate and provide a compelling online shopping experience to compete with luxury brands’ own e-commerce platforms.

Consumer Demand for Personalized Experiences

Consumers are increasingly demanding personalized shopping experiences and greater access to designer products. The merger aims to address these demands by leveraging artificial intelligence to tailor offerings and provide a more personalized shopping experience. This focus on personalization and convenience is crucial in attracting and retaining customers in the competitive luxury market.

However, the success of this strategy depends on effectively integrating technology and data analytics to understand and anticipate consumer preferences. Saks Global must invest in advanced analytics and customer relationship management systems to deliver on its promise of personalized experiences. Failure to do so could result in a loss of customer loyalty and market share.

Implications for Stakeholders

Vendors and Suppliers

The merger will significantly impact vendors and suppliers, particularly smaller ones that rely on wholesaling to Saks Fifth Avenue and Neiman Marcus. The combined entity’s increased negotiating power could lead to greater pressure on vendors to meet pricing and supply demands. While this could create opportunities for some vendors, it may also result in reduced bargaining power and increased financial strain for others.

Luxury brands that prioritize direct-to-consumer sales may also reassess their relationships with Saks Global. The merger’s impact on vendor relationships and bargaining power will be a critical factor in determining its long-term success.

Employees and Local Economies

The potential for store closures and job losses is a significant concern for employees and local economies. While the merger aims to optimize the retail footprint and reduce operating costs, this process may involve difficult decisions that negatively impact employees and communities. Saks Global must carefully manage these transitions and provide support to affected employees to mitigate negative outcomes.

Consumers

For consumers, the merger presents both opportunities and risks. On the one hand, the combined entity’s enhanced digital strategy and focus on personalization could provide a better shopping experience. On the other hand, reduced competition in the luxury retail market could lead to higher prices and fewer choices. The success of the merger will depend on how well Saks Global balances these competing interests and delivers value to consumers.

Conclusion

The merger of Saks Fifth Avenue and Neiman Marcus represents a significant development in the luxury retail landscape, with the potential to create substantial value through cost savings, operational efficiency, and a unified digital strategy. However, the merger also brings challenges, including regulatory scrutiny, operational disruptions, and the need to adapt to changing consumer preferences.

As of July 4, 2024, the success of the merger hinges on navigating these challenges and effectively leveraging the strategic benefits. Saks Global must focus on delivering a compelling and personalized shopping experience, both online and in-store, to attract and retain customers. The combined entity’s ability to innovate and adapt to market trends will be critical in determining its long-term success and impact on the luxury retail landscape.

In summary, while the merger has the potential to elevate the luxury retail market, its success will depend on careful execution, regulatory approval, and the ability to meet evolving consumer demands. The coming months will be crucial in shaping the future of Saks Global and its role in the luxury retail industry.

Related Articles

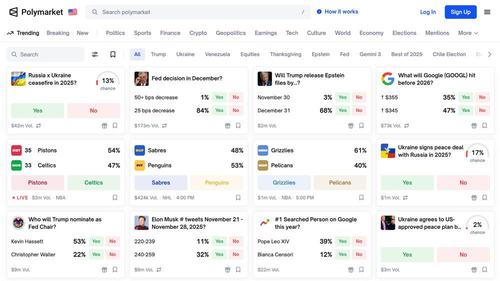

The Rise of Prediction Markets

Category

You may also like

No related articles available

Breaking News

View All →No topics available at the moment