AI-Driven Portfolio Intelligence for Modern Investors

Quantitative Factor Portfolio Toolbox

Professional suite for systematic factor portfolio construction, factor tilting, and sector analysis -- featuring Al-powered diagnostics and advanced stock screening

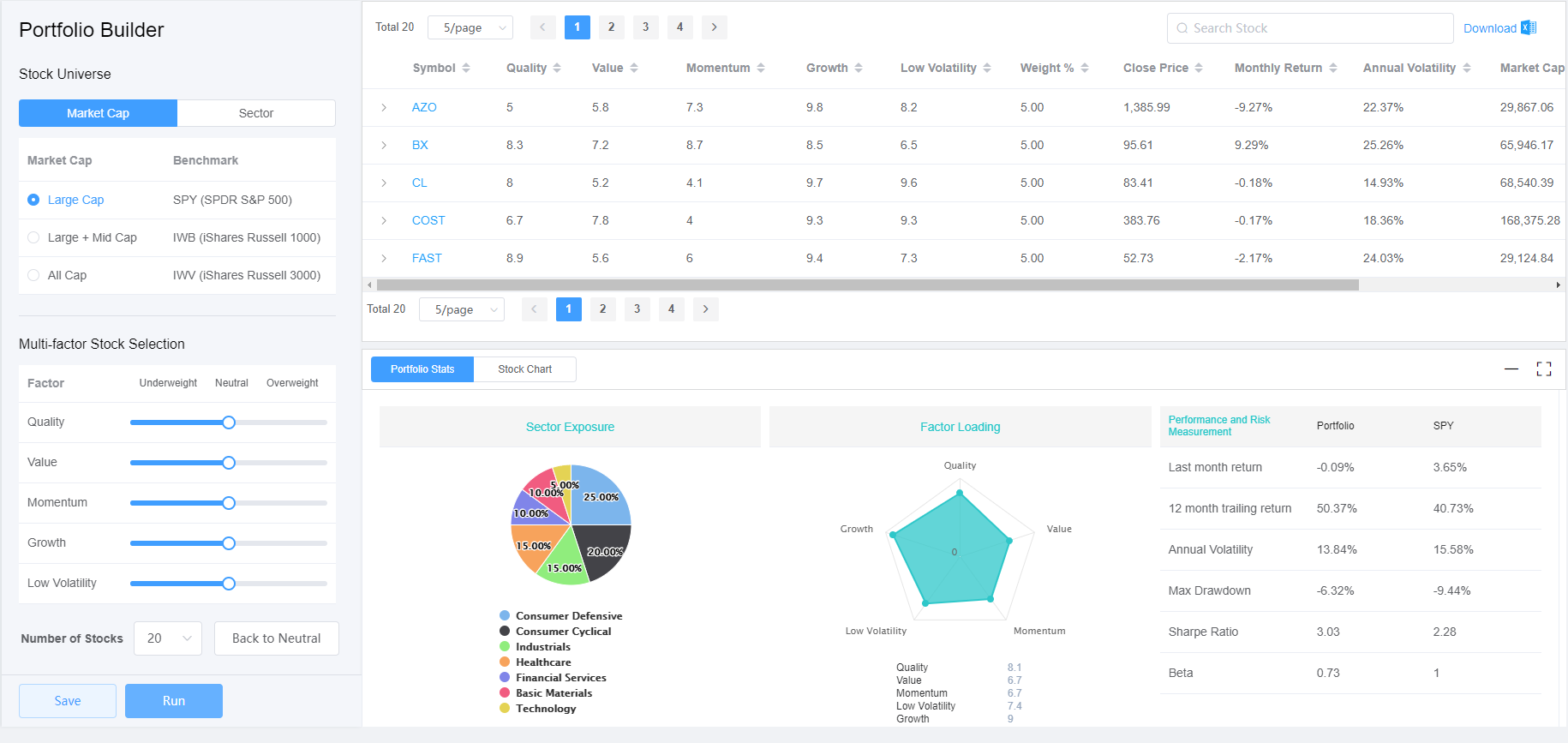

Portfolio Builder

Construct factor-tilted portfolios with sophisticated weighting schemes

Portfolio Diagnosis

Deep factor exposure analysis and portfolio decomposition

Multi-factor Screener

Advanced screening with composite ranking and factor layering

$19 first month

then $49 billed monthly

*US stock market data only

Simplified Portfolio Building with InvestGPT

Building portfolios is as easy as chatting! Just like in investGPT, simply input your stock or ETF symbols and let us handle the complexity. No need to understand the intricacies of systematic factor investing - we'll optimize your portfolio automatically.

Going beyond basic market-cap weighting, we'll automatically:

- Balance risk across your investments like the pros

- Optimize for better risk-adjusted returns

- Build a portfolio inspired by Bridgewater's proven strategy

What Portfolio Toolbox Offers

Helping Investors Build Smarter Stock Portfolios with Easy-to-Use Factor Investing Tools

Portfolio Builder

Construction from scratch

Build and analyze your customizable factor tilting portfolio from multiple stock universes and sectors.

Provide insights on factor loading of Quality, Value, Momentum, Growth & Low Volatility, sector exposure and portfolio return/risk statistics.

Portfolio Diagnosis

Existing portfolio analysis

Upload holdings or manually input stock list with choices of popular weighting scheme.

Insights on factor loading analysis, sector exposure, and detailed sub-factor level statistics.

Multi-factor Screener

Idea exploration

Stock pool selection based on 5 major factors, 60+ sub factors or a combination.

Stock ranking by factor scores, monthly return, annual volatility, market cap, sector and price.

Individual stock factor loading and interactive historical return chart.

Risk Parity Fundamentals

Risk Parity Fundamentals Introduction to Risk Parity and Budgeting

Introduction to Risk Parity and Budgeting